Half-Year Results Fiscal Year 2021/22 of the Barry Callebaut Group

Half-Year Results Fiscal Year 2021/22 of the Barry Callebaut Group

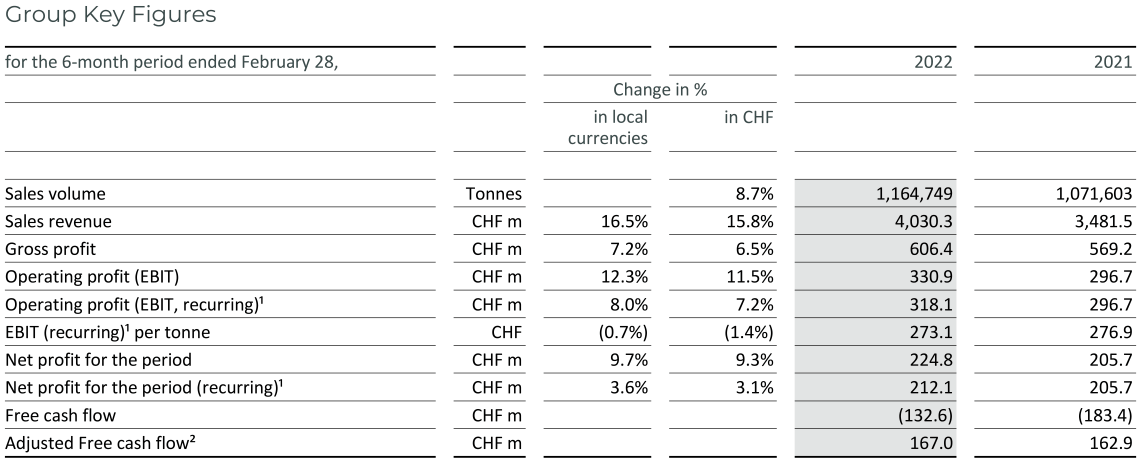

- Sales volume up +8.7%, with outstanding chocolate performance (+9.9%)

- Sales revenue of CHF 4.0 billion, up +16.5% in local currencies (+15.8% in CHF)

- Operating profit (EBIT) recurring1 of CHF 318.1 million, up +8.0% in local currencies

(+7.2% in CHF), EBIT reported up +12.3% in local currencies (+11.5% in CHF) - Net profit recurring1 of CHF 212.1 million, up +3.6% in local currencies (+3.1% in CHF),

Net profit reported up +9.7% in local currencies (+9.3% in CHF) - Continued good cash generation with adjusted Free cash flow2 of CHF 167.0 million

- Confident of delivering on mid-term guidance3

In the first six months of fiscal year 2021/22 we continued our strong growth trajectory, well ahead of the underlying chocolate confectionery market. A strong performance across the board, in particular in chocolate, delivered strong volume, solid profitability and continued good cash generation.

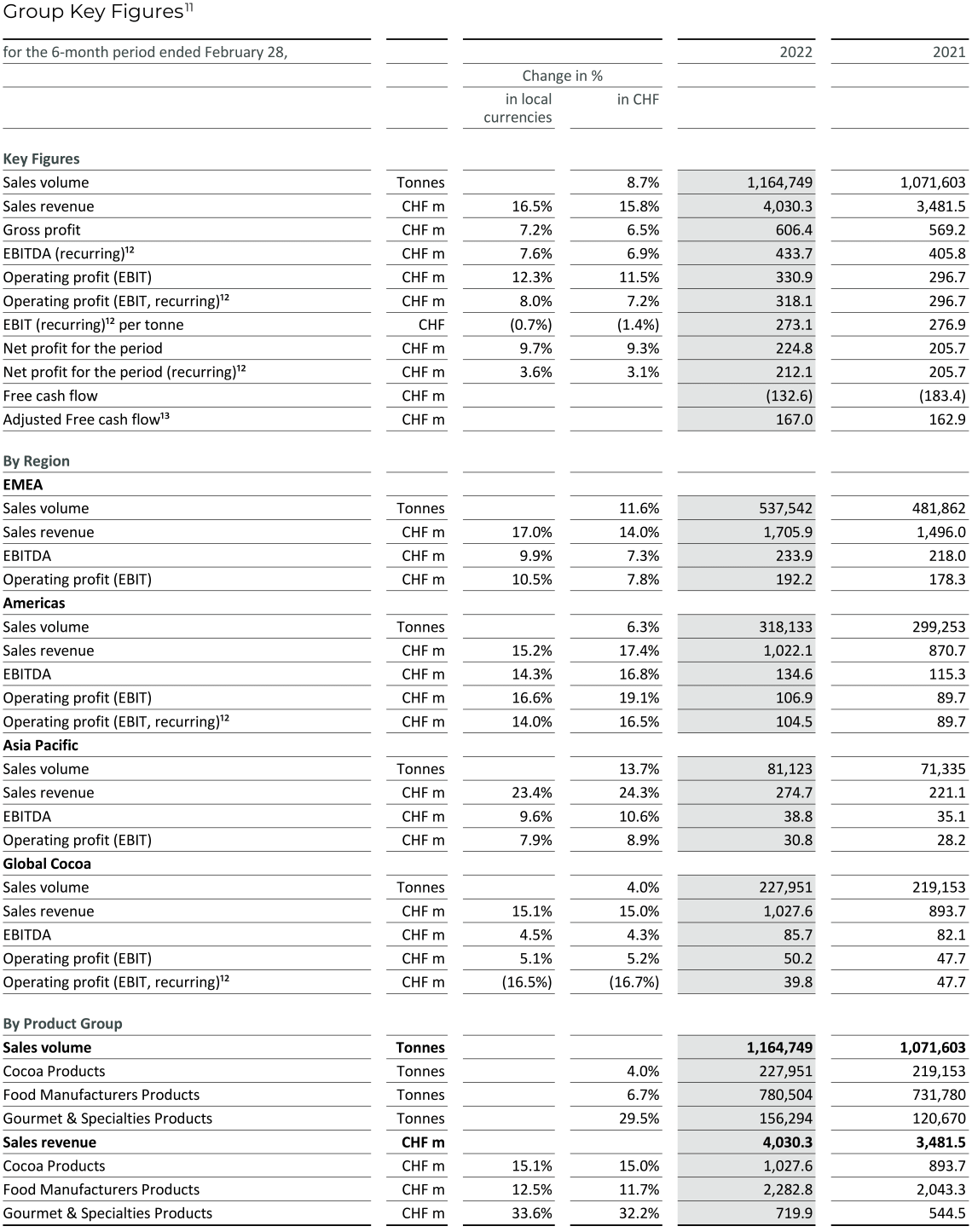

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, reported strong sales volume growth of +8.7% to 1,164,749 tonnes in the first six months of fiscal year 2021/22 (ended on February 28, 2022). Although achieved on a low comparison base, the result is well ahead of the Group’s pre-COVID-19 volume in fiscal year 2018/194. Excluding the first-time consolidation of Europe Chocolate Company (ECC) as of September 2021, organic volume growth in the period under review was +7.9%. Chocolate volume grew by an outstanding +9.9%, clearly outpacing the underlying global chocolate confectionery market (+2.0%)5.

The strong growth was supported by all Regions and key growth drivers: Outsourcing (+7.3%), Emerging Markets (+8.7%) and Gourmet & Specialties (+29.5%). Sales volume in Global Cocoa grew by +4.0% to 227,951 tonnes.

Sales revenue amounted to CHF 4,030.3 million, up +16.5% in local currencies (+15.8% in CHF). The increase was impacted by the overall inflationary environment, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business.

Gross profit amounted to CHF 606.4 million, up +7.2% in local currencies (+6.5% in CHF), growing overall in line with volume. The positive volume and mix effect was reduced through the negative impact of the cocoa business and the impairment of financial assets in Russia.

Operating profit (EBIT) recurring6 amounted to CHF 318.1 million, despite being affected by the aforementioned impairment of financial assets, leading to an increase of +8.0% in local currencies (+7.2% in CHF). The recurring EBIT per tonne was fairly stable at CHF 273, reflecting the strength of the cost-plus model. The recovery of indirect tax credits for prior fiscal periods related to a recent decision by the Brazilian Supreme Court applicable to all taxpayers had a positive impact of CHF +12.8 million. As a result, the reported EBIT amounted to CHF 330.9 million, up +12.3% in local currencies (+11.5% in CHF).

Net profit for the period recurring6 amounted to CHF 212.1 million, up +3.6% in local currencies (+3.1% in CHF) compared to prior-year Net profit. Net profit reported amounted to CHF 224.8 million, up by +9.7% in local currencies (+9.3% in CHF). The increase was supported by higher Operating profit (EBIT), which was partially offset by higher Net financing cost due to higher benchmark interest rates and impairments on cash in emerging markets, in particular in Russia. Income tax expenses amounted to CHF –47.1 million, which corresponds to an effective tax rate of 17.3% (17.4% in prior year).

Net working capital slightly increased to CHF 1,598.8 million from CHF 1,579.1 million in the prior-year period. The increase was well below the Group’s volume growth, thanks to overall good working capital management. Receivables increased on the back of strong business momentum. Inventories were higher to ensure product availability amidst the global supply chain constraints. Both increases were largely offset by higher payables.

Free cash flow continued to strengthen in the six months under review and amounted to CHF –132.6 million compared to CHF –183.4 million in the prior-year period. Adjusted for the effect of cocoa beans considered as readily marketable inventories (RMI), the adjusted Free cash flow amounted to a strong CHF 167.0 million (February 28, 2021: CHF 162.9 million).

Net debt further decreased to CHF 1,594.3 million from CHF 1,752.9 million in the prior-year period, driven by the Group’s strong Free cash flow generation. Taking into consideration the cocoa bean inventories as readily marketable inventories (RMI), the adjusted Net debt decreased to CHF 561.1 million compared to CHF 661.6 million in the prior-year period.

1 Operating profit (EBIT) recurring excluded CHF +12.8 million and Net profit for the period recurring excluded CHF +12.7 million for the recovery of indirect tax credits for prior fiscal periods related to a recent decision by the Brazilian Supreme Court applicable to all taxpayers.

2 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

3 On average for the 3-year period 2020/21 to 2022/23: 5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

4 Sales volume in the first six months of fiscal year 2018/19: 1,046,695 tonnes.

5 Source: Nielsen volume growth excluding e-commerce – 25 countries, September 2021 – January/February 2022, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

6 Operating profit (EBIT) recurring excluded CHF +12.8 million and Net profit for the period recurring excluded CHF +12.7 million for the recovery of indirect tax credits for prior fiscal periods related to a recent decision by the Brazilian Supreme Court applicable to all taxpayers.

Outlook – Confident of delivering on mid-term guidance

Looking ahead, CEO Peter Boone said:

I am profoundly heartened by the way our colleagues across the globe have come together to support those in need. Our strong team, our global footprint and our cost-plus model make us confident that we can deliver on our mid-term guidance in a continued volatile market environment.

Strategic milestones

Expansion: In March 2022, Barry Callebaut completed the expansion of its chocolate factory in Campbellfield, Australia, which the Group acquired in 2020. The new factory lines significantly enhance the total production capacity of the factory and its range of offerings, allowing for the first liquid chocolate deliveries in Australia. This expansion is in line with Barry Callebaut’s ambition to locate production close to customers and meets the increasing demand for high quality chocolate in Australia, which has the highest per capita consumption7 in Region Asia Pacific.

In early April 2022, Grupo Bimbo, the world’s largest baked goods company, and Barry Callebaut extended their strategic supply agreement, originally signed in 2012. Under the new global long-term agreement, Barry Callebaut will continue to supply chocolate and compound to Grupo Bimbo in Mexico, several countries in Central America, the US, Canada and Uruguay.

Innovation: In February 2022, Callebaut launched Callebaut NXT, a range of dark and milky tasting chocolates for chefs and artisans made from 100% plant-based ingredients. Callebaut NXT is produced in Norderstedt, Germany, the first fully dairy-free facility dedicated to supplying at scale chocolate guaranteed to be free of detectable traces of dairy. In parallel, Callebaut launched its NXT online platform, which offers artisans inspiration and recipes for premium plant-based chocolate delights.

In March 2022, two of Barry Callebaut’s recent innovations, Elix, Barry Callebaut’s cacaofruit elixir and the first nutraceutical fruit drink, and Cacao Barry’s latest innovation EvocaoTM WholeFruit chocolate, a unique chocolate made from 100% pure cacaofruit, made it to the finals at the World Food Innovation Awards 2022. The nominations are testimony to Barry Callebaut’s innovation strength and leadership on trends. In the end, EvocaoTM brought home the trophy

for ‘Best Artisan Product’.

Cost Leadership: Barry Callebaut is continuously improving its operational efficiency. As part of this strategy and to better balance production capacity and demand in the UK, an important market for Barry Callebaut, the Group started in March 2022 a consultation process on the potential closure of its chocolate factory in Moreton, UK. This would allow Barry Callebaut to continue to invest in the modernization of its factory footprint in the UK.

Sustainability: Barry Callebaut announced in February 2022 that since mid-2021 more than

50,000 native trees have been planted under its long-term reforestation project in the Agbo 2 Forest in Côte d’Ivoire. Together with external stakeholders and farmer communities, the Group aims to restore the forest, herewith protecting one of the world’s most biodiverse and fragile ecosystems and supporting cocoa farmer livelihoods. Barry Callebaut will continue to scale over the next three years to reach the objective of planting 150,000 trees on 300 hectares. This reforestation activity comes on top of the almost 2.7 million cocoa seedlings and almost 2 million non-cocoa trees the Group distributed in the previous fiscal year.

Also in February 2022, Barry Callebaut updated its Human Rights Statement. It describes Barry Callebaut’s approach and efforts toward safeguarding human rights in its supply chain. Barry Callebaut continued to expand its sustainable energy sources for its facilities. In March 2022, the factory in Port Klang, Malaysia, was equipped with more than 4,700 solar panels, reducing CO2e emissions by 1,500 tonnes per year. Already 26 out of the Group’s 64 factories are exclusively powered by renewable electricity.

7 Source: Euromonitor, chocolate confection per capita in Australia in 2021: 5.1 kg.

Regional/Segment performance

Region EMEA – Strong volume growth and sound profitability

Region EMEA (Europe, Middle East and Africa) reported strong sales volume growth of +11.6% to 537,542 tonnes in the first six months of the fiscal year. The integration of the Europe Chocolate Company (ECC) in Belgium, acquired in September 2021, progressed to full satisfaction. Excluding the first-time consolidation of ECC, organic volume growth was +10.3%, substantially outpacing the underlying regional chocolate confectionery market (+0.1%)8. Food Manufacturers saw continued strong volume growth, supported by healthy growth in Western Europe and the ramp-up of outsourcing volume in Eastern Europe. The strong volume recovery of Gourmet & Specialties continued across the Region. Sales revenue amounted to CHF 1,705.9 million, up +17.0% in local currencies (+14.0% in CHF). Operating profit (EBIT) increased by +10.5% in local currencies (+7.8% in CHF) to CHF 192.2 million. Despite the impairment of financial assets and investments in future growth, profitability was sound.

Region Americas – Accelerated volume growth and strong profitability

Sales volume in Region Americas accelerated in the second quarter and showed a strong +6.3% increase to 318,133 tonnes in the first six months. The growth was more than twice the underlying regional chocolate confectionery market growth (+3.0%)8 and was supported by both Food Manufacturers and Gourmet. The overall solid growth in Food Manufacturers was broad based and led by specialty chocolates. Gourmet & Specialties’ strong volume growth continued across the Region. Sales revenue amounted to CHF 1,022.1 million, up +15.2% in local currencies (+17.4% in CHF). Operating profit (EBIT) recurring9 grew by +14.0% in local currencies (+16.5% in CHF) reaching CHF 104.5 million on the back of good volume growth and the positive effect of the acceleration up the value ladder.

Region Asia Pacific – Vibrant volume growth momentum continued

Vibrant sales volume growth continued in Region Asia Pacific, up +13.7% to 81,123 tonnes in the first six months under review, in line with the underlying regional chocolate confectionery market (+13.9%)8. Food Manufacturers continued its double-digit volume growth, supported by strong growth in markets like China, India and Japan. Gourmet & Specialties’ volume growth continued its healthy momentum. Sales revenue amounted to CHF 274.7 million, up +23.4% in local currencies (+24.3% in CHF). The sales revenue increase was impacted by the overall inflationary environment, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business. Operating profit (EBIT) amounted to CHF 30.8 million, an increase of +7.9% in local currencies (+8.9% in CHF). Due to upfront investments in growth, mainly in Australia, profitability in Asia Pacific remained behind volume growth in the first six months of this fiscal year. Nevertheless, the regional profitability remains well ahead of the Group’s average profitability.

Global Cocoa – Impact of imbalanced cocoa market bottomed out

Sales volume in Global Cocoa increased by +4.0% to 227,951 tonnes in the first six months under review. Sales revenue amounted to CHF 1,027.6 million, up +15.1% in local currencies (+15.0% in CHF). Operating profit (EBIT)9 recurring amounted to CHF 39.8 million, a decrease of –16.5% in local currencies (–16.7% in CHF). The impact of the imbalanced cocoa market has bottomed out.

Price developments of the most important raw materials

During the first six months of fiscal year 2021/22, terminal market10 prices for cocoa beans fluctuated between GBP 1,636 and GBP 1,877 per tonne and closed at GBP 1,690 per tonne on February 28, 2022. On average, cocoa bean prices increased by +2.9% versus the prior-year period. Though the global bean supply and demand forecast for 2021/22 indicates a deficit, the large surplus in prior year will lead to a more balanced market situation.

Sugar prices in Europe increased on average by +31.6% during the period under review, mainly due to historically low stock levels and a resumption of demand. The world market price for sugar increased on average by +23.3% on the back of a substantially lower Brazilian crop and a macro-environment driven by high energy prices and record-high freight costs.

Dairy prices increased on average by +46.0% during the first six months of fiscal year 2021/22. While demand remained dynamic, global milk supply declined sharply as rising inflation squeezed farmer profits, which resulted in a strong price rally.

8 Source: Nielsen. The volume growth – excluding e-commerce – for the period September 2021 to January/February 2022. Data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

9 Operating profit (EBIT) recurring excluded CHF +2.4 million in Region Americas and CHF +10.4 million in Global Cocoa for the recovery of indirect tax credits for prior fiscal periods related to a recent decision by the Brazilian Supreme Court applicable to all taxpayers.

10 Source: London terminal market prices for 2nd position, September 2021 to February 2022. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Media and Analyst Webcast/Call of the Barry Callebaut Group

|

Date |

Wednesday, April 13, 2022 at 10:00–11:30 CEST |

|

Location |

Halle 550, Birchstrasse 150, Entrance C, 8050 Zurich |

This will be a physical conference hosted by Peter Boone, CEO, and Ben De Schryver, CFO, which can also be followed via telephone or webcast. Dial-in and access details can be found here.

Media Assets

Downloads

Financial Calendar for Fiscal Year 2021/22

(September 1, 2021 to August 31, 2022)

| Capital Markets Day | May 11, 2022 |

| 9-Month Key Sales Figures 2021/22 |

July 20, 2022 |

| Full-Year Results 2021/22 |

November 2, 2022 |

| Annual General Meeting 2021/22 |

December 14, 2022 |

11 Financial performance measures, not defined by IFRS, are defined in the Annual Report 2020/21 on page 182.

12 EBITDA and Operating profit (EBIT) recurring at Group level excluded CHF +12.8 million and Net profit for the period recurring excluded CHF +12.7 million for the recovery of indirect tax credits for prior fiscal periods related to a recent decision by the Brazilian Supreme Court applicable to all taxpayers. The effect is split as follows on regional level: EBIT recurring in Region Americas excluded CHF +2.4 million and in Global Cocoa excluded CHF +10.4 million.

13 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

About Barry Callebaut Group:

With annual sales of about CHF 7.2 billion (EUR 6.6 billion / USD 7.9 billion) in fiscal year 2020/21, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 13,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Follow the Barry Callebaut Group: