Chocolate makers aren’t spooked!

Discover the latest products and digital campaigns created by chocolate makers for Halloween 2020 from across U.S. and Canada

Jump to Top 10 Innovation Highlights from Halloween 2020 →

Halloween confectionery is worth $4.5bn in retail sales in the U.S*, and when it comes to trick-or-treating, American consumers love a mix of BOTH chocolate and candy… but the way to their hearts is with chocolate, with 59% of consumers saying that chocolate is their favorite kind of Halloween treat.**

Chocolate accounts for over half the Halloween confectionery market, making Halloween one of the biggest chocolate occasions of the year at $2.5bn in retail sales*. End-of-year holidays just take the top spot at $2.8bn, followed by Valentine’s and Easter at $1.9bn-a-piece. Sequentially, it means “All Hallows' Eve” really kicks off the annual chocolate cycle, starting in early September.

How Halloween Can Stay Safe

This year, American chocolate makers have been preparing for a different kind of Halloween, as Covid-19 restrictions mean traditional trick-or-treating can only take place in certain areas of the country.

The good news is that the industry had time to prepare for this moment, with some fantastic resources available to help consumers.

Guides to Celebrating Halloween Safely

- Halloween Central - Always a treat by the National Confectionery Association

- Halloween 2020 by Halloween Costume Association & Hershey

- Halloween guidelines by CDC

Halloween at Home

Despite limitations on trick-or-treating, consumers are planning to buy candy for themselves or their household, increasing from 56% last year to 62% this year****.

They also have new interactive digital campaigns to engage with Halloween virtually, from some of the market’s leading brands

Halloween Digital Campaigns

- 31 Days of Halloween by Ferrero

- Ghosthuntntrap.com by Ferrara Candy

- Halloween at Home by Yowie

- Treat Town by Mars

Undeterred by the potential challenges, chocolate makers and retailers have embraced the opportunity to bring chocolate lovers new delights, from pumpkin spice treats for some much-needed comfort and nostalgia, to innovative Fall flavors to mark the turning of the season.

Halloween-specific chocolates are worth $383m* (15% of total Halloween chocolate sales) and saw growth in the early season in 2020, driven by early retail displays encouraging savvy shoppers to stock up.

These novelties really tap into consumer desire to have chocolates that feel personal to each moment, with 39% of U.S. consumers agreeing that they prefer exclusive or limited edition chocolates.*****

Updating pumpkin with all clean ingredients

By Chocolate Chocolate Chocolate

Giving a fun fright with a flash of color

By Reese’s

Best-selling flavors in a novel shape, with sustainably sourced cocoa

By Chocolove

Creating FOMO demand with new fall flavors

By Compartés

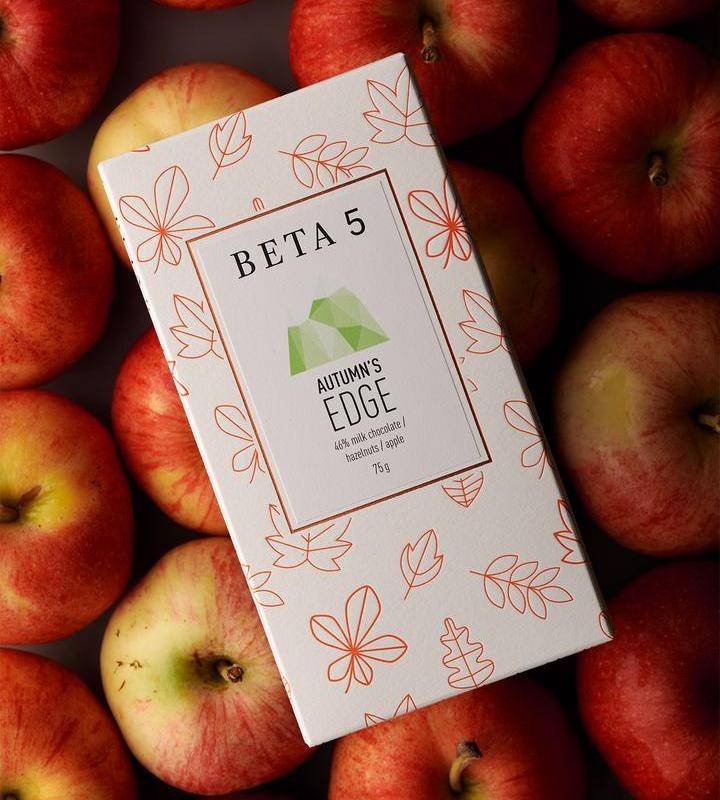

Elevating a limited edition with Dark Milk chocolate

By Beta 5

Bringing some novelty to snacking with pumpkin in creamy white chocolate

By Lake Champlain

Taking the Starbucks famous flavor into a truffle

By Purdy's Chocolatier

Tapping into the return to home baking and evoking the comfort of warm Apple pie

By Seattle Chocolate

Making it easier for in-home sharing with a variety pack

By Affy Tapple

Warming up to Winter with a premium spices

By Moonstruck

Next on the horizon are the end of year holidays including Hanukkah and Christmas, followed by Valentine’s in the new year.

The good news for confectioners is that these holidays are typically celebrated with chocolate shared between close friends, partners, and family at home, rather than with neighbors in the community. This means there will be less change to traditions due to Covid restrictions. We even expect some consumers to spend more money on those occasions, especially on affordable luxuries like chocolate gifts.

2020 is the year for extra special chocolate treats!

Sources

*IRI USA Multi-Outlet + Convenience (scanned at cash registers). Halloween 8wks ending Nov 3, 2019, End of Year Holidays 8 wks ending Dec 29, 2019, Valentine’s 6 weeks ending Feb 16, 2020, Easter 7wks ending 4/12/2020

**NCA Sweet Insights, Shopper Research among 1500 shoppers, 2019

***IRI 52 weeks 15 ending 12/29/2019 MULO+C

****Numerator Custom Holiday Survey 08/14/2020

*****BC proprietary research study, 2019