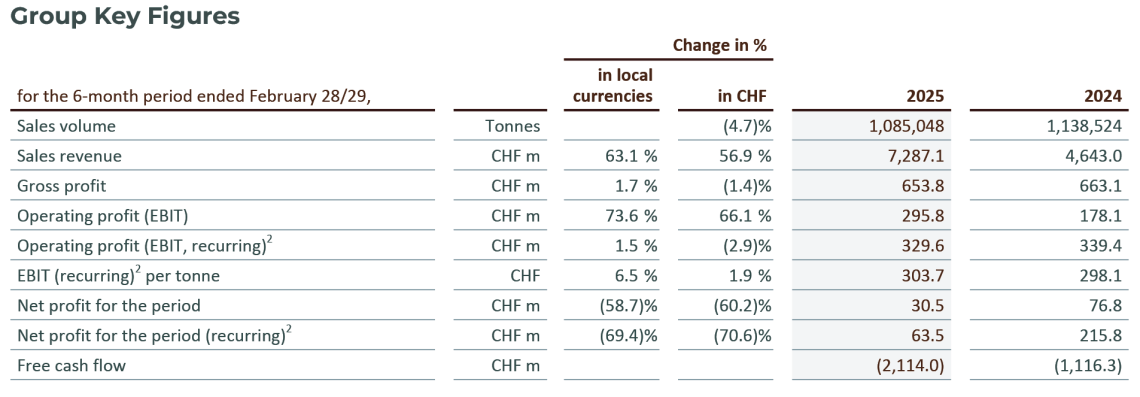

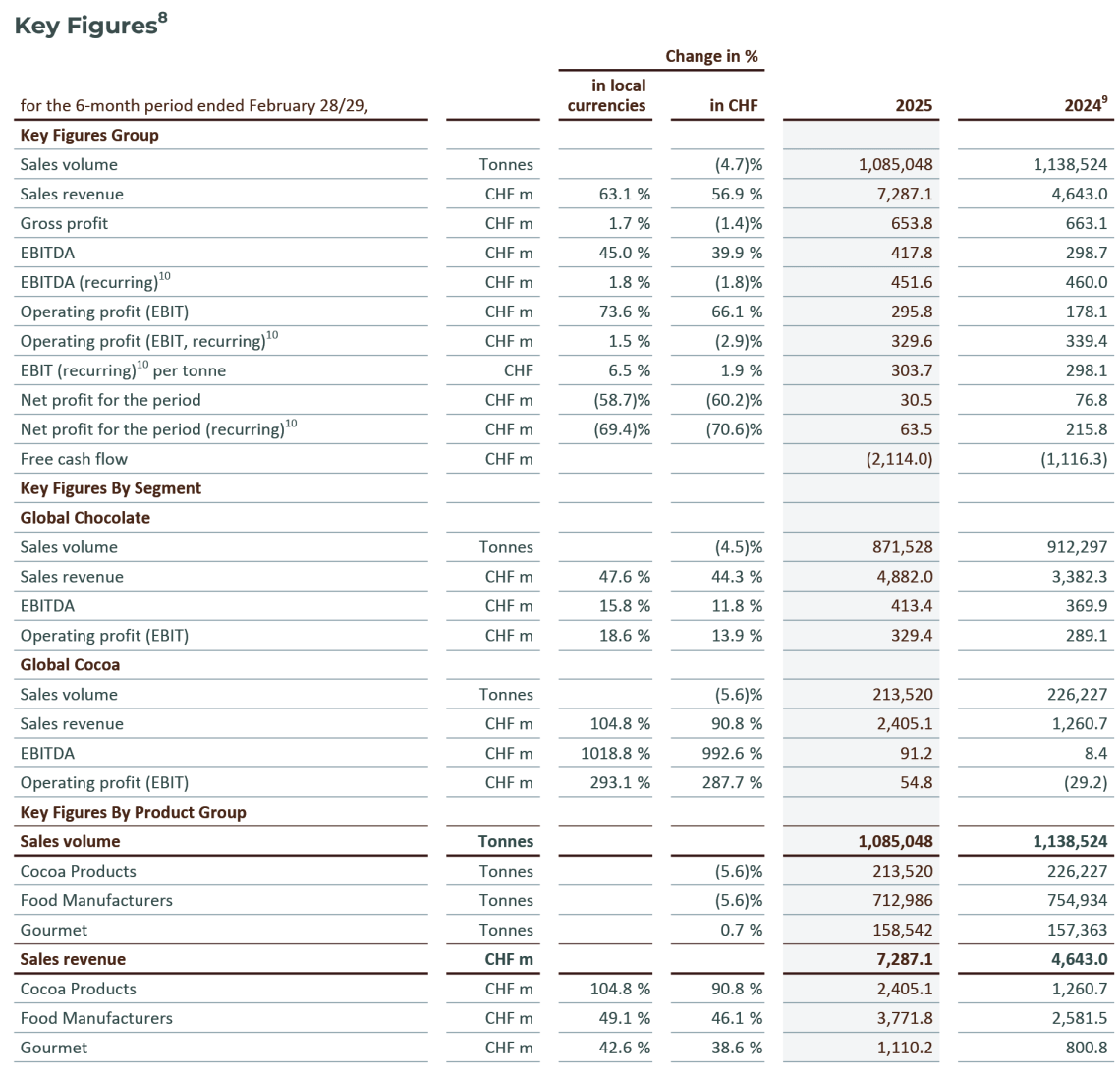

The Barry Callebaut Group reported sales volume of 1,085,048 tonnes in the first six months of fiscal year 2024/25 (ended February 28, 2025). The highly volatile market environment impacted customer behavior and pricing, resulting in a sales volume decrease of -4.7%.

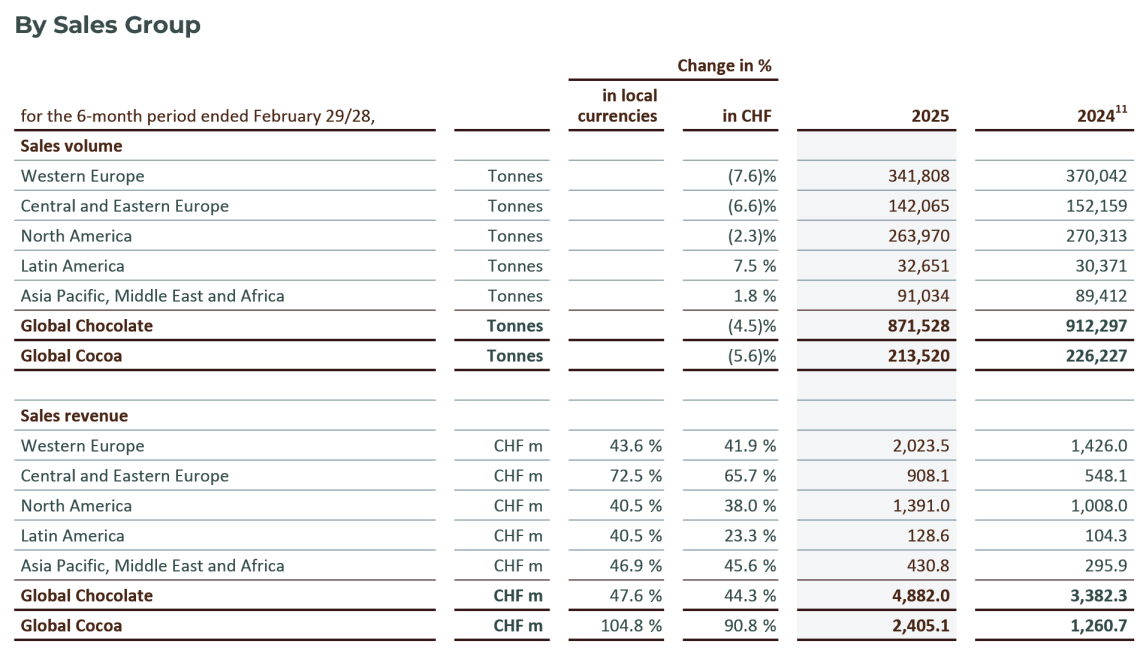

Sales volume for Global Chocolate decreased by -4.5% in a declining global chocolate confectionery market according to Nielsen3 (-2.4%). Food Manufacturers (-5.6%) were significantly impacted by market dynamics with large pricing actions, historically low levels of customer orders and other short-term changes to customer behavior given the volatility. Gourmet (+0.7%) delivered positive growth, recovering in the second quarter with resilient demand across most regions.

Looking at regional performance within Global Chocolate, Latin America (+7.5%) was the strongest contributor to volume performance, with solid demand across clusters supported by innovative customer solutions. Asia Pacific, Middle East and Africa (AMEA, +1.8%) saw double-digit growth in India, Indonesia and the Middle East, which was partially offset by macro-economic factors further impacting performance in China. North America reported a volume decrease of -2.3%, impacted by decisive action to temporarily close the Toluca facility in Mexico and weaker demand for large Food Manufacturers, which more than offset new customer wins. Central and Eastern Europe (-6.6%) saw lower volumes for several large regional and local Food Manufacturer customers, especially in Türkiye. Volume development in Western Europe (-7.6%) was significantly impacted by high pricing and changed customer behavior in the challenging market environment, such as selective insourcing, as well as SKU rationalization. The region was also partly impacted by the high base of comparison, with a large one-off contract in the prior-year period.

Sales volume for Global Cocoa declined -5.6% as the business prioritized volume in the supply constrained environment and saw a negative demand impact from significant cocoa bean price increases, particularly in AMEA and CEE.

Sales revenue amounted to CHF 7,287.1 million, up +63.1% in local currencies (+56.9% in CHF). The increase was driven by Barry Callebaut's cost-plus pricing model as the business passed through significantly higher cocoa bean prices to customers.

Gross profit amounted to CHF 653.8 million, up +1.7% in local currencies (-1.4% in CHF), supported by the company's cost-plus pricing model as well as mix.

Operating profit (EBIT) recurring2 amounted to CHF 329.6 million, an increase of +1.5% in local currencies (-2.9% in CHF) compared to the prior year. The increase came despite the impact of negative volume growth due to lower and delayed customer demand in light of record bean prices, as the cost-plus model successfully passed on a significant portion of cost increases.

Recurring4 EBIT per tonne amounted to CHF 304, up +6.5% in local currencies (+1.9% in CHF). Recurring4 EBIT for Global Chocolate was CHF 340.1 million, up +2.0% in local currencies (-2.3% in CHF). Recurring4 EBIT for Global Cocoa was CHF 49.4 million, up +11.1% in local currencies (+7.6% in CHF), supported by volume prioritization in the supply constrained environment.

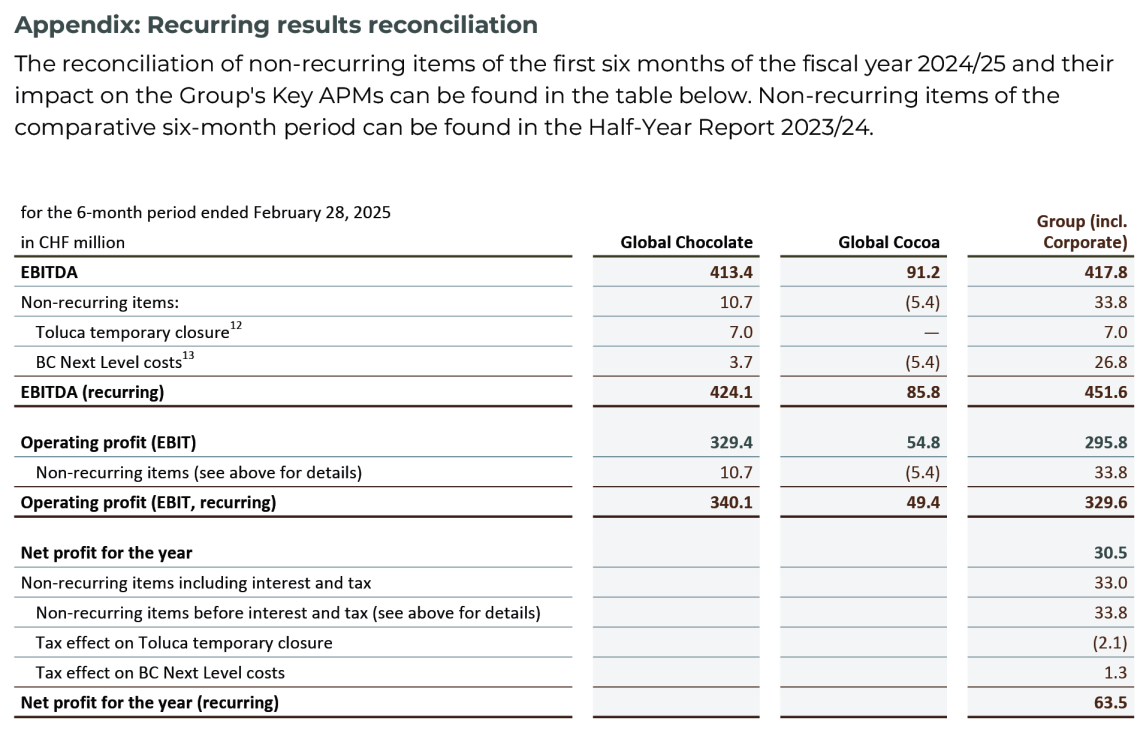

EBIT reported was CHF 295.8 million, compared to CHF 178.1 million in the prior year (+73.6% in local currencies and +66.1% in CHF). Net one-off BC Next Level operating expenses amounted to CHF 26.8 million.

Net profit for the period recurring4 amounted to CHF 63.5 million, down -69.4% in local currencies (-70.6% in CHF). Performance was impacted by significantly higher financing costs and steep backwardation in the market, with the cost-plus model not able to fully pass on the major increases to customers given the unprecedented speed of market volatility, low customer orders and the longer pricing cycle in Gourmet. Net finance costs increased significantly to CHF -196.7 million, up from CHF -72.1 million in the prior year, mostly as a result of the higher debt level in the context of the cocoa bean price acceleration as well as increased interest rates. Net profit reported was CHF 30.5 million, including net one-off BC Next Level operating expenses.

Net working capital increased to CHF 5,900.8 million from CHF 2,775.7 million in the prior-year period. The increase was due to the substantial negative impact from twice as high cocoa bean prices, given the long cycle between bean contracting and customer sales, as well as a significant increase in initial and variation margins required by futures exchanges given the volatile environment.

Free cash flow generation amounted to CHF -2,114.0 million, compared to CHF -1,116.3 million in prior-year period, due to the substantial cocoa bean price related working capital increase.

Adjusted Net debt5 increased to CHF 2,919.1 million, compared to CHF 245.7 million in the prior-year period, taking into consideration the cocoa bean inventories as readily marketable inventories (RMI). The increase is predominantly due to the around CHF 2 billion increase in inventory value, including RMI as well semi-finished and finished products, following almost twice as high cocoa bean prices. As a result adjusted5 net debt / EBITDA recurring4 was 3.1x.

3 Source: Nielsen volume growth excluding e-commerce – 26 countries, August 2024 - January 2025. Data subject to adjustment to match Barry Callebaut's reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

4 Please refer to appendix (on page 9 of the PDF) for the detailed recurring results reconciliation.

5 Net debt adjusted for cocoa bean inventories regarded by the Group as readily marketable inventories (February 2025: CHF 3,192.5 million; February 2024: CHF 2,391.7 million).