Over the past 5 years, US consumers claim to have tried the following diets:

30% high protein | 34% low sugar | 6% vegan | 5% keto

How are these eating lifestyles shaping chocolate confectionery & snacks?

Dark Chocolate is marketed as Vegan, and Milk-Like Chocolate is the next frontier

Vegan is defined as a way of living that attempts to exclude all forms of animal exploitation. For these reasons, the vegan diet is devoid of all animal products. By definition semi-sweet/dark chocolate only consists of vegan ingredients (cocoa, sugar, lecithin) and fits a plant-based diet. However, unless it is dairy-free certified there is always the risk of cross-contamination due to traces of milk from the manufacturing facility. Dark tablets grew 15% in retail value between 2014-2019, which shows the long term trend for dark chocolate (Source: Euromonitor

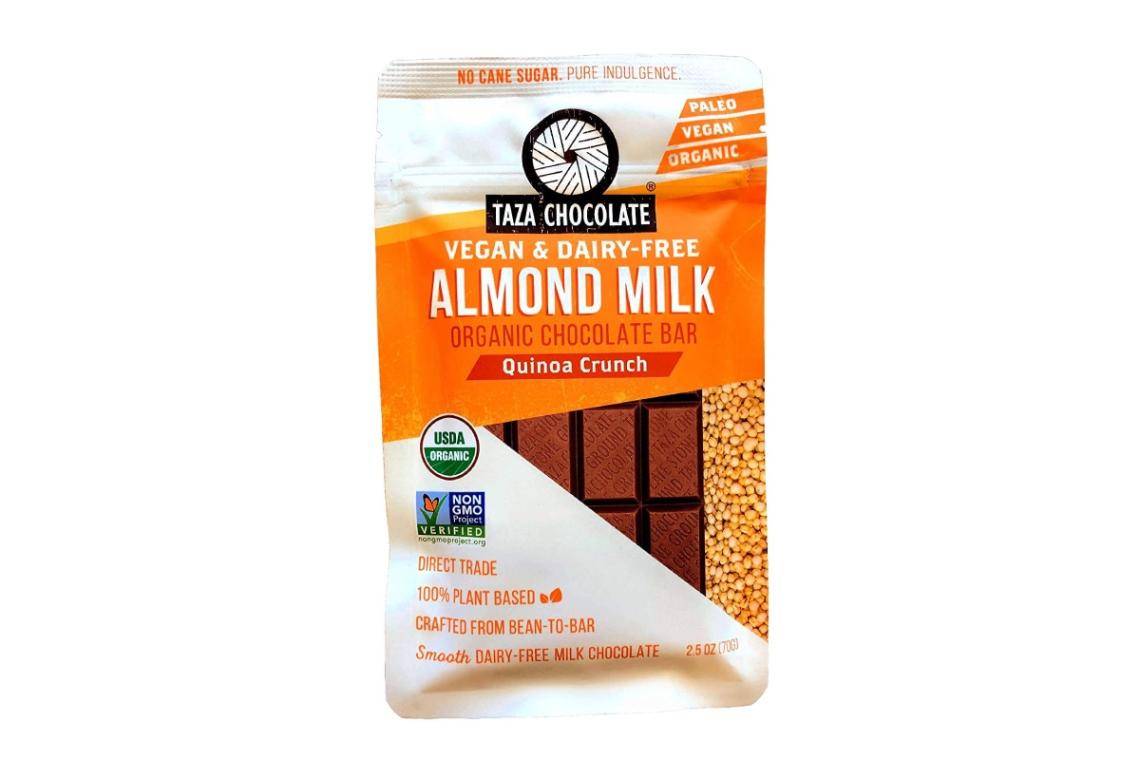

Vegan chocolate is growing. The number of new Snack Bars and Chocolate Confectionery products launched with vegan claims grew 24% year-on-year in 2019 (Source: Mintel GNPD). We are also starting to see boutique brands launch “milk-like” chocolate, where creamy alternatives to milk, such as rice milk, nut milk, or oat milk, are used to create that velvety mouth-feel. As these milk alternatives become commonplace in consumer fridges, they will be equally open to trying these in their chocolate snacks. Vegan consumers are looking for the latest creamy chocolate experiences that taste close to milk chocolate, without compromising their lifestyle choice.

Taza launched vegan chocolate bars in February 2020 made using on-trend alternative milk

Kind launch their famous plant-based snack bars into the Freezer in June 2020

High Protein Snack Bars continue to grow, with category space in Confection.

The high protein diet emphasizes consumption of high-protein-containing foods to either lose weight or gain lean muscle mass. As a result we’ve seen nutritional, sports, and cereal brands embracing the opportunity to offer consumers protein-rich bars as a convenient snack. Now 44% of U.S bar eaters say protein content is an important factor in their bar choice, typically looking for between 5-14g of protein (Source: Mintel Report on Snack, Nutrition and Performance Bars - US - February 2019).

As the category continues to grow, we are seeing innovation and renovation in this space with double or multiple claims, combining a source of/high protein with claims like gluten free and dairy free.

We are also seeing the trend toward fun and indulgent flavors, as brands recognise this is typically a “reward” moment and therefore an emotional positioning, not just functional, resonates.

Whilst 32% of North American consumers say protein is important when purchasing chocolate, only 13 chocolate confectionery products carrying high/added protein claims were launched in 5 years from 2014-2019, showing opportunity for high protein innovation outside of snack bars (Source: BC proprietary study, North America, 2019; Mintel GNPD). There is an untapped opportunity particularly in panned fruit and nuts to bring more “health halo” options to these bite size confections!

RXBAR launched an influencer Hot Chocolate bar in February 2020 with 12g of Protein

Women-owned Trubar launch a range protein bars “as delicious as your favorite treats” in 2020

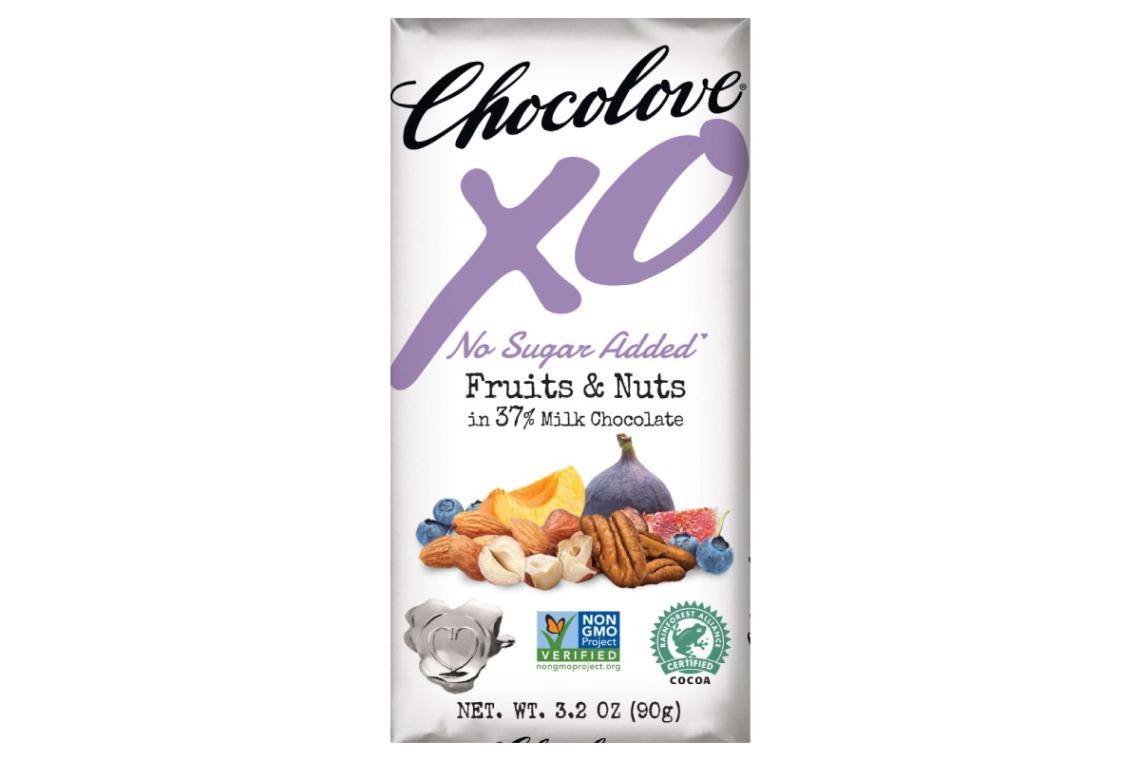

Trend for Reduced Sugar Chocolate shifts to tighter target: Keto Treats

The keto diet is a low-carb, high-fat diet. The reduction in carbs and replacement by high fats puts the body into a metabolic state called ketosis. Sugar Free chocolate confectionery continues to grow in the market, now worth $160m in the U.S in 2019 and growing 22%. Sugar free is the strongest claim, but just as important are “No Added Sugar” and “Reduced Sugar”, as 31% of North American consumers say low sugar is important when purchasing chocolate (Source: BC proprietary study, North America, 2019)

Brands are increasingly using bold “Keto” claims on pack to attract this specific consumer and ensure their core consumer is not disappointed with a different taste profile for this lifestyle. What’s more, confectioners are recognizing they need to communicate about carbs, not just sugar. According to Innova, the number of launches tracked in North America with the claim “low carb” in Chocolate Confectionery & Snack Bars doubled between 2018 and 2019 (Source: Innova, BC proprietary study, North America, 2019).

Chocolove launched their ‘No Sugar Added’ range in 2020 with “the same great taste with no odd aftertaste”

Evolved launched a Keto Nut Butter bar using a blend of nuts & ethically sourced cocoa

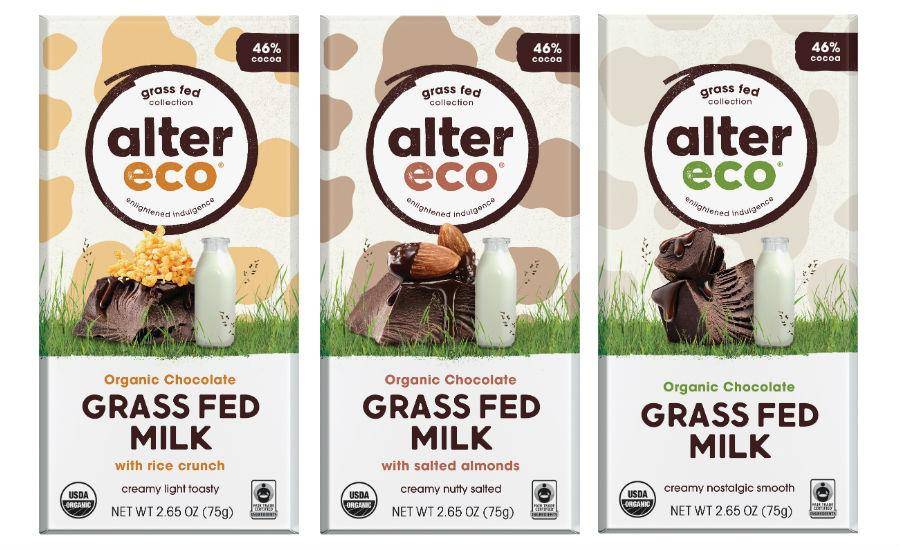

Paleo continues to drive growth in Chocolate Confectionery & Snacks

The paleo diet includes lean meats, fish, dairy, fruits, vegetables, nuts, and seeds--foods that, in the past, could be obtained by hunting and gathering. The paleo follower looks for items with only few non-processed, non-artificial ingredients or even no label at all.

‘Natural’ has been the top claim for new chocolate flavored products for over 10 years (source: Mintel GNPD), with a long term trend in confectionery moving away from artificial ingredients. Meanwhile, snack bars have an inferred health halo, where 20% of North American consumers say the role snack bars play in their overall diet is to “improve health” (Source: Mintel Report on Snack, Nutrition and Performance Bars - US - February 2019)

What’s next? The new generations of consumers are seeking simple ingredient lists, with 47% of Millennials saying that a clean label is important when purchasing chocolate (Source: BC proprietary study, North America, 2019). We are also seeing the addition of “goodness” with natural ingredients, and a shift to “clean energy” in snack bars, with natural sources of their functional benefits.

This Saves Lives expanded their ‘school safe’ range in 2020 with crispy bars made with “a blast of chocolate, crispy rice, and other real ingredients.”

Alter Eco launched their Grass Fed Milk Chocolate in summer 2020, leading on natural and added goodness.

Want to be inspired by confectionery & snack ideas for today’s ‘Eating Lifestyles?'

Download our ‘Eating Lifestyles’ Confectionery Ideation Guide for ideas on how to make these diet trends come to life for your brand along with a full overview of Barry Callebaut’s ‘Eating Lifestyles’ confectionery-specific chocolate & nut solutions.

This guide provides:

-

8 confection & snack concept ideas from our innovative team of Chefs

-

Our selection of confectionery solutions for high-protein, vegan, keto, and paleo diets

-

Recent insights on diet trends in chocolate confectionery & snacks