Barry Callebaut Group – 9-Month Key Sales Figures, Fiscal Year 2019/20

Barry Callebaut Group – 9-Month Key Sales Figures, Fiscal Year 2019/20

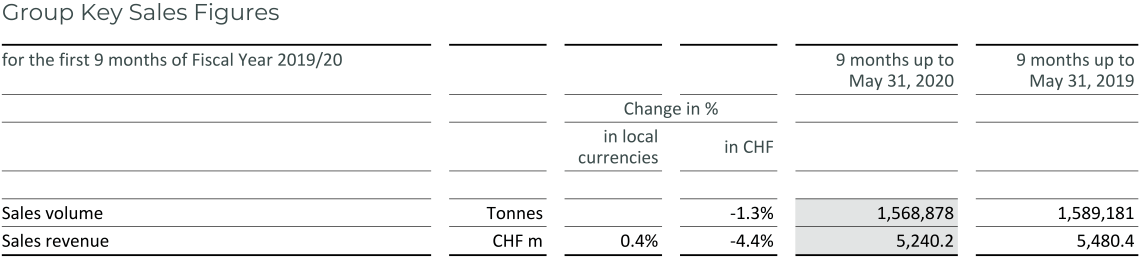

- Sales volume down –1.3% in the first nine months, due to COVID-19 third quarter sales volume down –14.3%

- Sales revenue of CHF 5.2 billion, up +0.4% in local currencies (–4.4% in CHF)

- Signs of sales volume recovery in June, as lockdowns are easing

- Confident outlook resulting in updated mid-term guidance with increased metrics: on average, for the 3-year period 2020/21 to 2022/23, +5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events1. Updated mid-term guidance excludes fiscal year 2019/20 and starts in September 2020

As anticipated in April, COVID-19 lockdowns across the globe impacted our sales volume in the third quarter, and herewith the good momentum of the first six months of fiscal year 2019/20. Throughout the COVID-19 pandemic, the precautionary measures we put in place early on allowed us to preserve business continuity and maintain a high service level for our customers worldwide, whilst protecting the health of our employees and the communities we operate in. We expect to emerge from the crisis with even closer relationships with our customers and suppliers, with fresh insights into innovative ways of doing business and a solid financial basis.

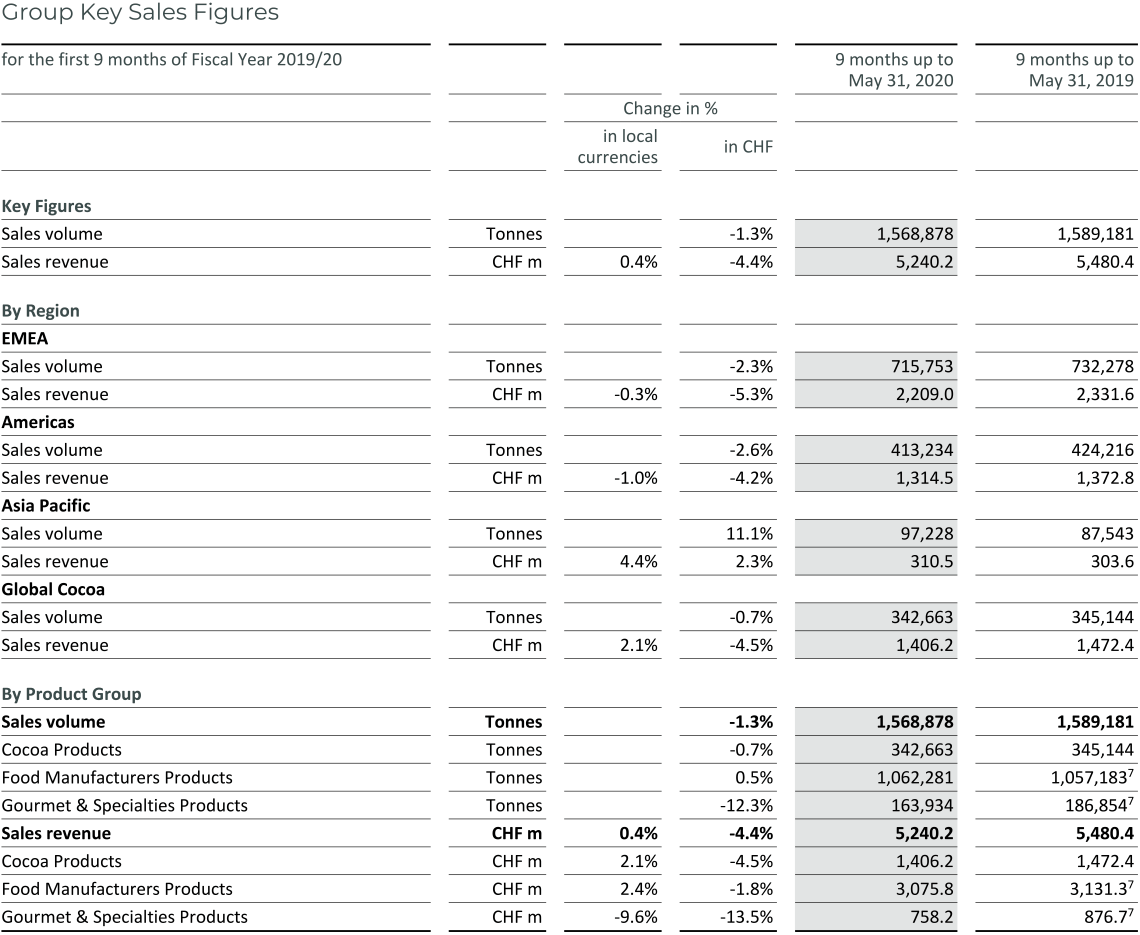

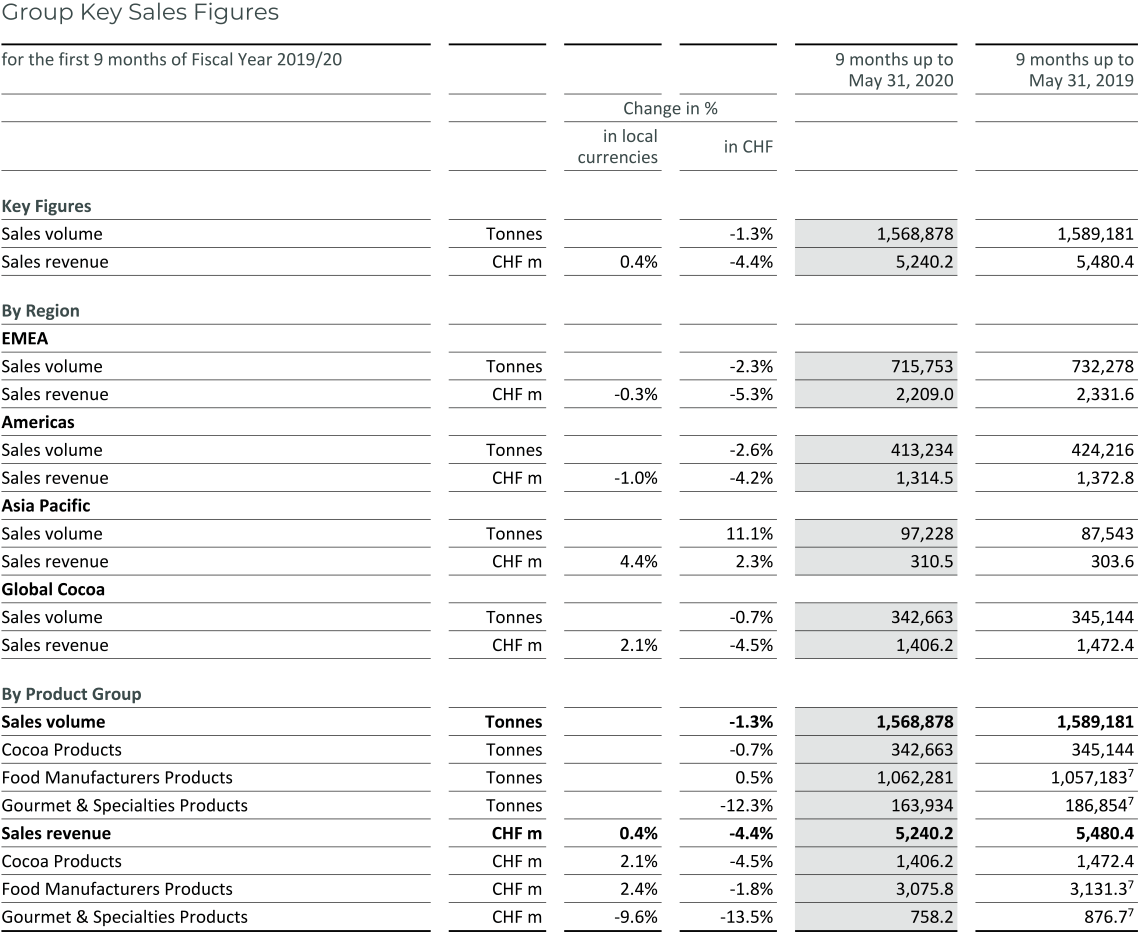

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, saw its good growth momentum of the first six months impacted by COVID-19 with volumes declining in the third quarter (ended May 31, 2020) by –14.3%. This led to an overall decline in the Group’s sales volume of –1.3% to 1,568,878 tonnes in the first nine months of fiscal year 2019/20. Sales volume in the chocolate business declined by –14.1% in the third quarter, leading to a slight decline of –1.4% for the first nine months. The underlying global chocolate confectionery market in the first nine months was flat (0.0%2) according to Nielsen. Global Cocoa volumes were down –14.6% in the third quarter and about flat for the nine-month period under review (–0.7%). Sales revenue in the first nine months amounted to CHF 5.2 billion, an increase of +0.4% in local currencies (–4.4% in CHF).

In June the Group saw a gradual sales volume recovery, as governments started to lift their COVID-19 measures. These early signs of recovery are visible both in Food Manufacturers and Gourmet & Specialties, albeit at a different pace.

1 Based on the assumption of a gradual recovery from COVID-19 without major lockdown resurgence.

2 Source: Nielsen volume growth excluding e-commerce, September 2019 to April 2020 – 25 countries, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption, which was heavily impacted by the lockdowns due to COVID-19.

COVID-19 update

Thanks to the precautionary measures and commitment of its employees, Barry Callebaut is able to keep its operations running and maintain a high level of service to its customers. In the face of the COVID-19 pandemic, the Group adopted precautionary measures early on to provide safe working environments for its employees and to maintain business continuity. In addition to the Group’s already strict hygiene standards, additional measures were put in place in factories, offices, laboratories and distribution centers. These measures include new hygiene protocols, social distancing on the work floor, remote working and limitation of travel. The Group also supported its employees in adjusting to the new normal.

Outlook – Updated mid-term guidance reflects confidence

Looking ahead, CEO Antoine de Saint-Affrique said:

We are confident we should rapidly regain momentum as markets are gradually reopening. This confidence is bolstered by the quality of our customer relationships, the breadth of our business model, as well as our strong innovation pipeline and balance sheet. The COVID-19 pandemic is a major unforeseen event which will have a negative impact on fiscal year 2019/20. This is why we update our mid-term guidance3, excluding fiscal year 2019/20 and introducing increased metrics of, on average for the 3-year period 2020/21 to 2022/23, +5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events4. The updated mid-term guidance starts in September 2020.

3 On average for the 3-year period 2019/20 to 2021/22: +4-6% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

4 Based on the assumption of a gradual recovery from COVID-19 without major lockdown resurgence.

Strategic milestones in the first nine months of fiscal year 2019/20

Expansion: The Group deepened its presence in Region Asia Pacific, by adding in June 2020 a fourth production line to its chocolate factory in Senoko, Singapore. The fourth production line supports Barry Callebaut as the largest producer of chocolate and cocoa products in Asia Pacific in satisfying increased demand from Southeast Asian countries, South Korea, and beyond.

In May 2020, Barry Callebaut signed an agreement to acquire GKC Foods (Australia) Pty Ltd, a producer of chocolate, coatings and fillings, serving many consumer chocolate brands in Australia and New Zealand. The acquisition was completed in July 2020. The acquisition of GKC Foods establishes Barry Callebaut’s direct presence and manufacturing capacity in the growing Australian market and empowers the Group to leverage its value-adding Gourmet & Specialties business in Australia and New Zealand.

Also in May 2020, Barry Callebaut signed a significant outsourcing agreement in Region Eastern Europe, Middle East and Africa (EEMEA) for the supply of compound and chocolate. The ramp-up of deliveries will start in the first quarter of fiscal year 2020/21.

Innovation: In the first nine months of the fiscal year, Ruby – the fourth type of chocolate – entered the product category of ice cream. Next to the roll-out of Magnum Ruby across the world, Starbucks introduced the 'Ruby Flamingo Frappuccino' in June 2020, available in select stores across EMEA. Ruby chocolate is now available in more than 50 markets and has been introduced by close to 100 brands.

Inspired by new ways of working during the COVID-19 pandemic, Barry Callebaut launched ‘BC LIVE’ in the United States and Canada, a digital customer events platform. In the webinars, led by Barry Callebaut’s industry experts, customers deep dive into today’s chocolate trends and solutions.

Earlier this year, the Group’s Gourmet brand Mona Lisa introduced ‘Mona Lisa 3D Studio’, the world’s first personalized 3D printed chocolate at scale. Hotels, pastry chefs and coffee chains can soon offer customized 3-D printed chocolate made from Belgian chocolate to their customers.

Sustainability: In March 2020, Barry Callebaut published its 2019 progress report under the Cocoa & Forests Initiative (CFI), a multistakeholder initiative to end deforestation caused by cocoa farming in Côte d’Ivoire and Ghana. The Group mapped over 222,000 farms in Côte d’Ivoire and Ghana, and has distributed over 3 million cocoa seedlings and over 750,000 shade trees. In addition, Barry Callebaut helped to protect over 6,000 hectares of primary forest and restore 3,800 hectares of forest.

In Japan, Barry Callebaut partnered with Yuraku Confectionery to raise awareness on the growing Japanese consumers’ interest in sustainability and to develop sustainable products for Japanese customers. 72% of Japanese consumers consider sustainability an important factor when purchasing food and drinks5

5 Source: Forever Chocolate Sustainability Consumer Research by Barry Callebaut, June 2019.

Regional/Segment performance

Region EMEA – Third quarter impacted by COVID-19, significant outsourcing contract signed

Sales volume of Barry Callebaut in Region Europe, Middle East and Africa (EMEA) declined by –2.3%6 to 715,753 tonnes in the first nine months of fiscal year 2019/20. Excluding the first-time consolidation of Inforum as of February 2019, organic volume declined by –4.3% in the nine-month period under review. The full lockdown in all major European markets for the majority of the third quarter negatively impacted sales volume, which declined by –17.1% in the third quarter.

The out-of-home and impulse consumption was particularly impacted, as restaurants, hotels and most shops were closed. This was reflected in the nearly halved volumes of Gourmet & Specialties, as well as in the double-digit volume decline in Food Manufacturers.

The signing of a significant outsourcing contract in EEMEA amidst the COVID-19 pandemic in May 2020 is a strong signal of the resilience of Barry Callebaut’s underlying business model. The ramp-up of deliveries will start in the first quarter of 2020/21.

Sales revenue in the first nine months of fiscal year 2019/20 was about flat (–0.3%) in local currencies (–5.3% in CHF) and amounted to CHF 2,209.0 million.

Region Americas – Third quarter impacted by COVID-19

Sales volume of Barry Callebaut in Region Americas declined by –2.6%6 to 413,234 tonnes in the period under review. The impact of the COVID-19 pandemic was reflected in the –12.1% volume decline in the third quarter. Food Manufacturers declined in the third quarter in North America in the high single-digit range. This decline was mainly driven by customers serving the out-of-home channel. Gourmet, which depends to a large extent on out-of-home consumption, lost about a third of its volume due to the lockdowns. In South America, the Group saw its volume decline in the third quarter by a third, mostly driven by Brazil, which has been particularly impacted by COVID-19.

The Region’s sales revenues in the first nine months of fiscal year 2019/20 declined by –1.0% in local currencies (–4.2% in CHF) to CHF 1,314.5 million.

Region Asia Pacific – Solid growth, continued recovery in China

Sales volume of Barry Callebaut in Region Asia Pacific continued to grow at a double-digit pace (+11.1%6) in the first nine months of fiscal year 2019/20 and amounted to 97,228 tonnes.

The COVID-19 pandemic and the corresponding government measures impacted the third quarter, resulting in an overall flat volume development (+0.4%) in the third quarter. The Gourmet business was in particular affected. Nevertheless, the speedy recovery of demand in key markets such as China and Japan cushioned the impact of the lockdowns, limiting the Gourmet volume decline to about one-fifth versus the prior-year quarterly volume. Food Manufacturers showed good resilience and grew mid-single digit in the third quarter. With the acquisition of GKC Foods, closed in early July 2020, Barry Callebaut has established a local presence and manufacturing capacity in the growing and still largely captive Australian market.

Sales revenue in the first nine months of fiscal year 2019/20 increased by +4.4% in local currencies (+2.3% in CHF) to CHF 310.5 million.

6 The underlying chocolate confectionery market growth according to Nielsen does not include e-commerce and only partially reflects the out-of-home and impulse consumption. According to Nielsen, the volume growth for the period September 2019 to April 2020 was: EMEA +1.1%, Americas -2.5%, Asia-Pacific +0.1%.

Global Cocoa – Stable performance in challenging market conditions

Sales volume of Global Cocoa remained stable in the first nine months of fiscal year 2019/20 (–0.7%) at 342,663 tonnes. Besides the impact of COVID-19, the comparison base from the previous year was also high, leading to a –14.6% decline in the quarterly volume.

Sales revenue in the nine-month period under review increased by +2.1% in local currencies (–4.5% in CHF) to CHF 1,406.2 million, reflecting higher cocoa bean prices.

Price developments of the most important raw materials

During the first nine months of the current fiscal year cocoa bean prices fluctuated between GBP 1,734 and GBP 2,045 per tonne and closed at GBP 1,840 per tonne on May 29, 2020. On average, cocoa bean prices increased by +11.4% versus the prior-year period. Global bean supply and demand is expected to show a surplus with a forecasted lower demand for the remaining part of 2019/20. Côte d’Ivoire and Ghana announced in July 2019 a living income differential (LID) of

USD 400 per tonne of cocoa beans, effective as of the 2020/21 crop.

Sugar prices in Europe increased on average by +11.6% compared to the prior-year period. This was mainly due to a poor crop and reduction in capacity induced by low prices in previous years. World sugar prices on average increased by +1.9%.

Dairy prices increased on average by +28.2% compared to the same prior-year period on the back of weak milk supply and strong demand in the first six months of the period under review. Due to COVID-19 demand slowed down in the third quarter.

Downloads

Media and Analyst webcast of the Barry Callebaut Group

| Date: Thursday, July 9, 2020 at 10:00–11:00 CEST |

| The call can be followed via telephone or webcast. Dial-in and access details can be found here |

Financial Calendar for Fiscal Year 2019/20 (September 1, 2019 to August 31, 2020):

| Full-Year Results 2019/20 | November 11, 2020 |

| Annual General Meeting 2019/20 | December 9, 2020 |

7 Certain Gourmet & Specialties customers have been shifted to the Food Manufacturers product group to better serve them. The minor reallocation represented less than 2% of Gourmet & Specialties volume and sales revenues in the nine months of fiscal year 2018/19.

8 Certain Gourmet & Specialties customers have been shifted to the Food Manufacturers product group to better serve them. The minor reallocation represented less than 2% of Gourmet & Specialties volume and sales revenues in the nine months of fiscal year 2018/19. The table shows quarterly adjusted numbers for 2018/19 and 2019/20.

About Barry Callebaut Group

With annual sales of about CHF 7.3 billion (EUR 6.5 billion / USD 7.4 billion) in fiscal year 2018/19, the Zurich-based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,000 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The two global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.