3-Month Key Sales Figures

Fiscal Year 2021/22

3-Month Key Sales Figures

Fiscal Year 2021/22

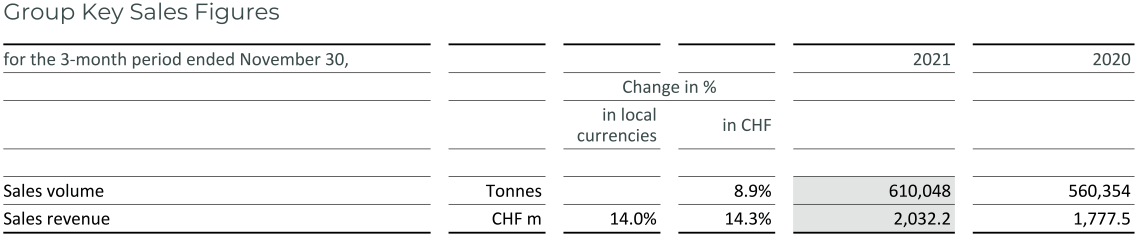

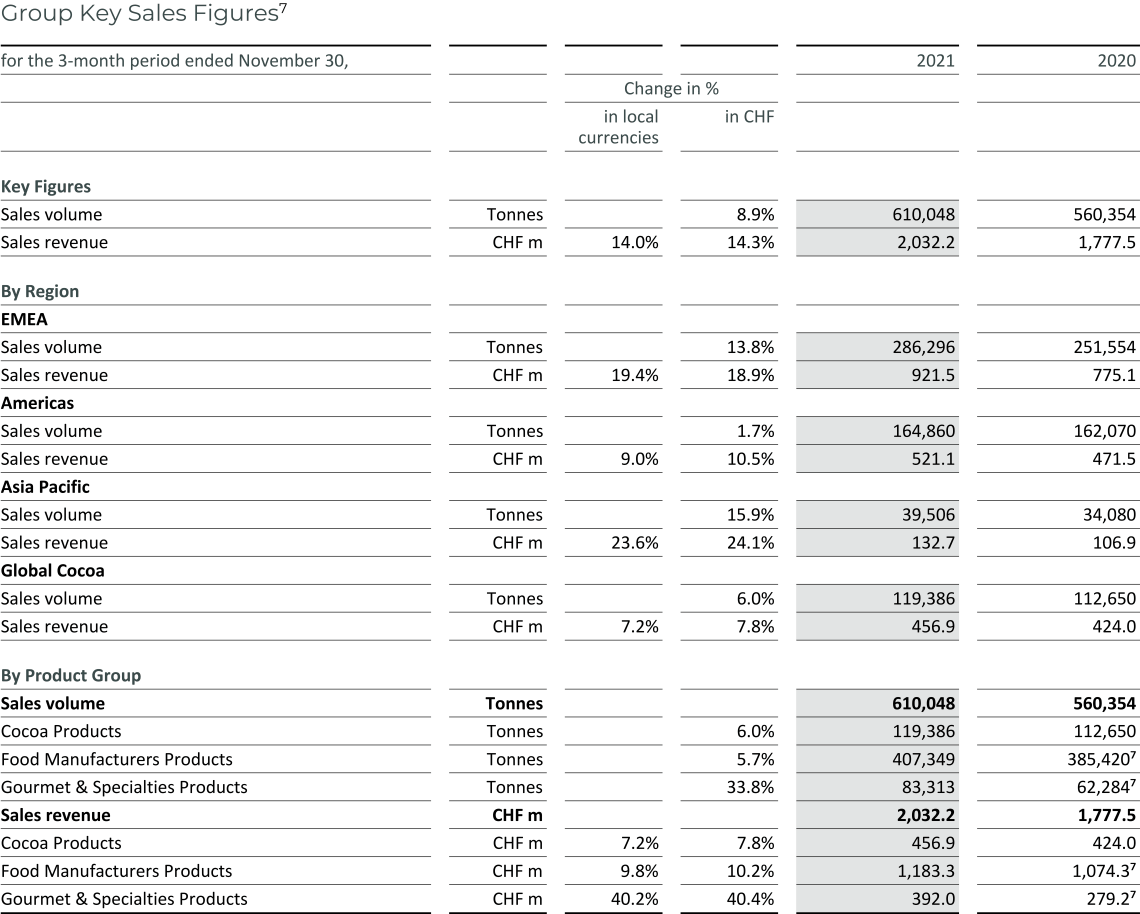

- Sales volume up +8.9%, driven by strong chocolate business (+9.6%)

- Sales revenue of CHF 2,032.2 million, up +14.0% in local currencies (+14.3% in CHF)

- On track to deliver on mid-term guidance1

I am pleased to present strong volume growth for the first three months of the new fiscal year. Chocolate volume growth was particularly strong, outperforming the underlying global chocolate confectionery market. At the same time, Global Cocoa returned to positive growth in a still challenging market environment.

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, achieved strong sales volume growth of +8.9% to 610,048 tonnes during the first three months of fiscal year 2021/22 (ended November 30, 2021). While this was achieved against a weak comparison base, it was well ahead of the Group’s pre-COVID-19 volume2 in 2019/20. Organic volume growth was +8.1% in the period under review, excluding the first-time consolidation of Europe Chocolate Company (ECC) as of September 2021. The chocolate business showed particularly strong volume growth of +9.6%, clearly outpacing the underlying global chocolate confectionery market (+3.1%)3. All Regions and key growth drivers contributed to these strong results: Gourmet & Specialties +33.8%, Emerging Markets +11.0%, Outsourcing +4.5%. Global Cocoa reported positive volume growth of +6.0% in an ongoing challenging market environment. Sales revenue amounted to CHF 2,032.2 million, up +14.0% in local currencies ( +14.3% in CHF) in the first three months under review. The increase was impacted by the overall inflationary environment, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business.

1On average for the 3-year period 2020/21 to 2022/23: 5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

2 Sales volume in 3-month period 2019/20: 585,620 tonnes.

3 Source: Nielsen volume growth excluding e-commerce – 25 countries, September to October 2021, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

Outlook – On track to deliver on mid-term guidance

Looking ahead, CEO Peter Boone said:

With our strong team and sharpened business model, we are confident we will deliver on our mid-term guidance. We are well placed to continue our growth journey in a global market environment which, as expected, is still experiencing the ripple effects of COVID-19, including supply chain bottlenecks and the impact of an imbalanced cocoa market.

Strategic milestones

Expansion: Barry Callebaut strengthened its position in Latin America. After the successful launch of its global decorations brand Mona Lisa in Brazil, the largest decorations market in Latin America, Mona Lisa continued its geographical expansion by entering Mexico, its 50th market worldwide, in November 2021. Mona Lisa offers a full range of high-quality decorations made from 100% sustainably sourced cocoa and is tapping into the growing demand for visually exciting indulgence. In October 2021, Godiva Japan pioneered the launch of Wholefruit Chocolate at its Atelier de Godiva, introducing applications from tablets to hot chocolate. Japan is one of seven countries selected for the first launch of Cacao Barry Wholefruit Chocolate.

Innovation: To further increase the visibility of its global Gourmet brand Cacao Barry, Barry Callebaut broke new ground by sponsoring the highly successful Netflix series "School of Chocolate", which has been on air since November 2021. In December 2021, Barry Callebaut’s cacao brand Bensdorp inaugurated the refurbished Masters of Cacao Excellence Center in Louviers, France. It welcomes customers from across the globe seeking to deepen their expertise in cocoa, to further explore the versatility of cocoa and to create new applications.

Sustainability: Barry Callebaut published in December 2021 its fifth Forever Chocolate progress report, marking the half-way point of its plan to make sustainable chocolate the norm by 2025. The report shows that the Group is scaling and partnering for change, executing innovative projects, supporting cocoa farming communities and driving measurable impact on the ground. Since 2016 the Group has reduced its carbon intensity per tonne of product by slightly more than –17%. Furthermore, Barry Callebaut has mapped the geographical location and size of 394,305 (+42%) active cocoa farms, covering 66% of its direct supply chain. Its child labor monitoring and remediation systems now cover 237 farmer groups (+110%), including 220,878 farmers in Côte d’Ivoire, Ghana, and Cameroon. In addition, 43% of the products Barry Callebaut sold in 2020/21 contained 100% sustainable cocoa or chocolate. The full report can be accessed here.

Also in December 2021, out of nearly 12,000 companies which were scored by Carbon Disclosure Project (CDP), Barry Callebaut was one of only 24 high-performing companies, securing a place on CDP’s prestigious ‘A List’. In addition to ranking for four years in a row as a CDP global climate leader with a score of ‘A-‘ for its climate reduction efforts, the Group is now also making the ‘A List’ as a leader in corporate action and transparency on deforestation. CDP’s annual environmental disclosure and scoring process is widely recognized as the gold standard of corporate environmental transparency.

Regional/Segment performance

Region EMEA – Strong start to the year

Sales volume in Region EMEA (Europe, Middle East and Africa) increased by +13.8% to 286,296 tonnes in the first three months under review. Organic volume growth was +12.6%, excluding the first-time consolidation of ECC as of September 2021. While the strong volume growth in the first quarter was achieved against a low comparison base, it clearly outpaced the underlying chocolate confectionery market (0.0%)4. Food Manufacturers volume further accelerated and achieved close to double-digit growth in the first three months of the fiscal year.

The acceleration was led by continued positive momentum in Eastern Europe, where outsourcing contracts are ramping up. The strong volume recovery of Gourmet & Specialties continued across the Region. Sales revenue in the Region amounted to CHF 921.5 million, up +19.4% in local currencies (+18.9% in CHF).

Region Americas – Sustained positive volume growth

In the first three months of fiscal year 2021/22, positive volume growth continued in Region Americas with an increase of +1.7% to 164,860 tonnes. This result, which is below the regional chocolate confectionery market (+5.4%)5, was achieved on the back of a strong comparison base, as the Group’s growth in the Region was more resilient throughout the COVID-19 pandemic. Food Manufacturers volume overall remained about stable against the high comparator. In Gourmet & Specialties, strong volume growth continued across the Region. Sales revenue amounted to CHF 521.1 million, up +9.0% in local currencies ( +10.5% in CHF).

Region Asia Pacific – Accelerating volume growth

In Region Asia Pacific growth momentum further accelerated by +15.9% to 39,506 tonnes, on the back of a low comparison base and in line with the underlying chocolate confectionery market (+18.8%)5. Food Manufacturers volume accelerated to the low teens, supported by key markets like India and Japan. Gourmet & Specialties volume continued its double-digit growth trajectory. Sales revenue amounted to CHF 132.7 million, up +23.6% in local currencies (+24.1% in CHF).

Global Cocoa – Return to positive growth in challenging market environment

On the back of the low prior-year comparator, sales volume in Global Cocoa was back to positive growth at +6.0% to 119,386 tonnes. Sales revenue increased by +7.2% in local currencies (+7.8% in CHF) to CHF 456.9 million. The COVID-19 ripple effects of an imbalanced cocoa market and supply chain bottlenecks continued to create a challenging environment.

Price developments of key raw materials

During the first three months of fiscal year 2021/22, terminal market6 prices for cocoa beans fluctuated between GBP 1,648 and GBP 1,888 per tonne and closed at GBP 1,648 per tonne on November 30, 2021. On average, cocoa bean prices increased by +2.1% versus the prior-year quarter. The global bean supply and demand forecast for 2021/22 has shifted from a surplus to a deficit, as a result of concerns over crop developments in Ghana and expectations of record high bean grindings.

Sugar prices in Europe increased on average by +28.8% during the period under review, mainly due to the poor crop and a historic low stock level. The world market price for sugar increased on average by +31.3% on the back of a substantially lower Brazilian crop, while demand remained strong. The increase was amplified by high energy prices and record high freight costs.

Dairy prices increased on average by +36.0% during the first three months of fiscal year 2021/22. Demand remained vibrant, but the primary driver for the price rally was a sharply reduced global milk supply as rising inflation is weighing on farmer profits.

4 Source: Nielsen volume growth – excluding e-commerce – for the period September to October 2021. Data is subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

5 Source: Nielsen volume growth – excluding e-commerce - for the period September to October 2021. Data is subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

6 Source: London terminal market prices for 2nd position, September to November 2021. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Financial Calendar for Fiscal Year 2021/22

(September 1, 2021 to August 31, 2022)

| Half-Year Results 2021/22 | April 13, 2022 |

| Capital Markets Day | May 11/12, 2022 |

| 9-Month Key Sales Figures 2021/22 | July 20, 2022 |

| Full-Year Results 2021/22 | November 2, 2022 |

| Annual General Meeting 2021/22 | December 14, 2022 |

Available downloads

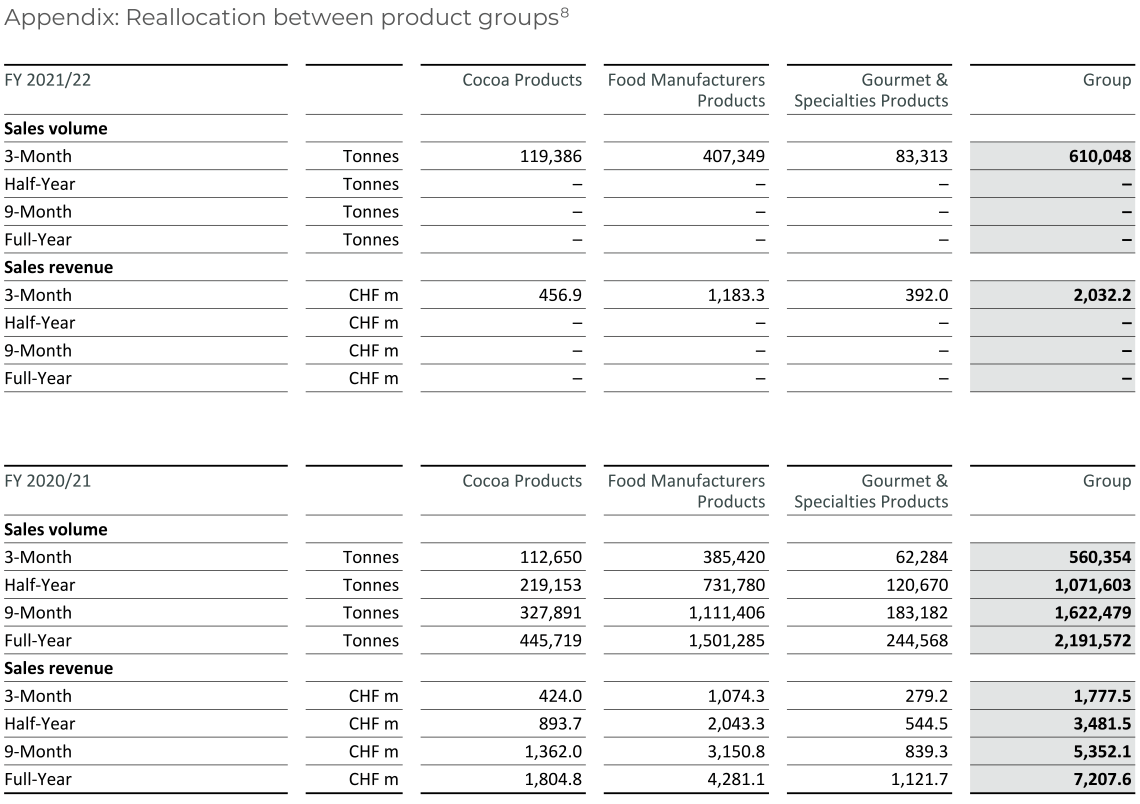

7 Certain Gourmet & Specialties customers have been shifted to the Food Manufacturers product group to better serve them. The minor reallocation represented around 1% of Gourmet & Specialties volume and sales revenue in fiscal year 2020/21. Please refer to Appendix below for full details.

8 Certain Gourmet & Specialties customers have been shifted to the Food Manufacturers product group to better serve them. The minor reallocation represented around 1% of Gourmet & Specialties volume and sales revenue in fiscal year 2020/21. The table shows quarterly adjusted numbers for 2020/21.

About Barry Callebaut Group:

With annual sales of about CHF 7.2 billion (EUR 6.6 billion / USD 7.9 billion) in fiscal year 2020/21, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,500 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Follow the Barry Callebaut Group: