Annual Report

2021/22

Annual Report

2021/22

Download center

Chairman of the Board, Patrick De Maeseneire, and CEO Peter Boone

Letter to Shareholders

Key Figures

Fiscal year 2021/22 in brief

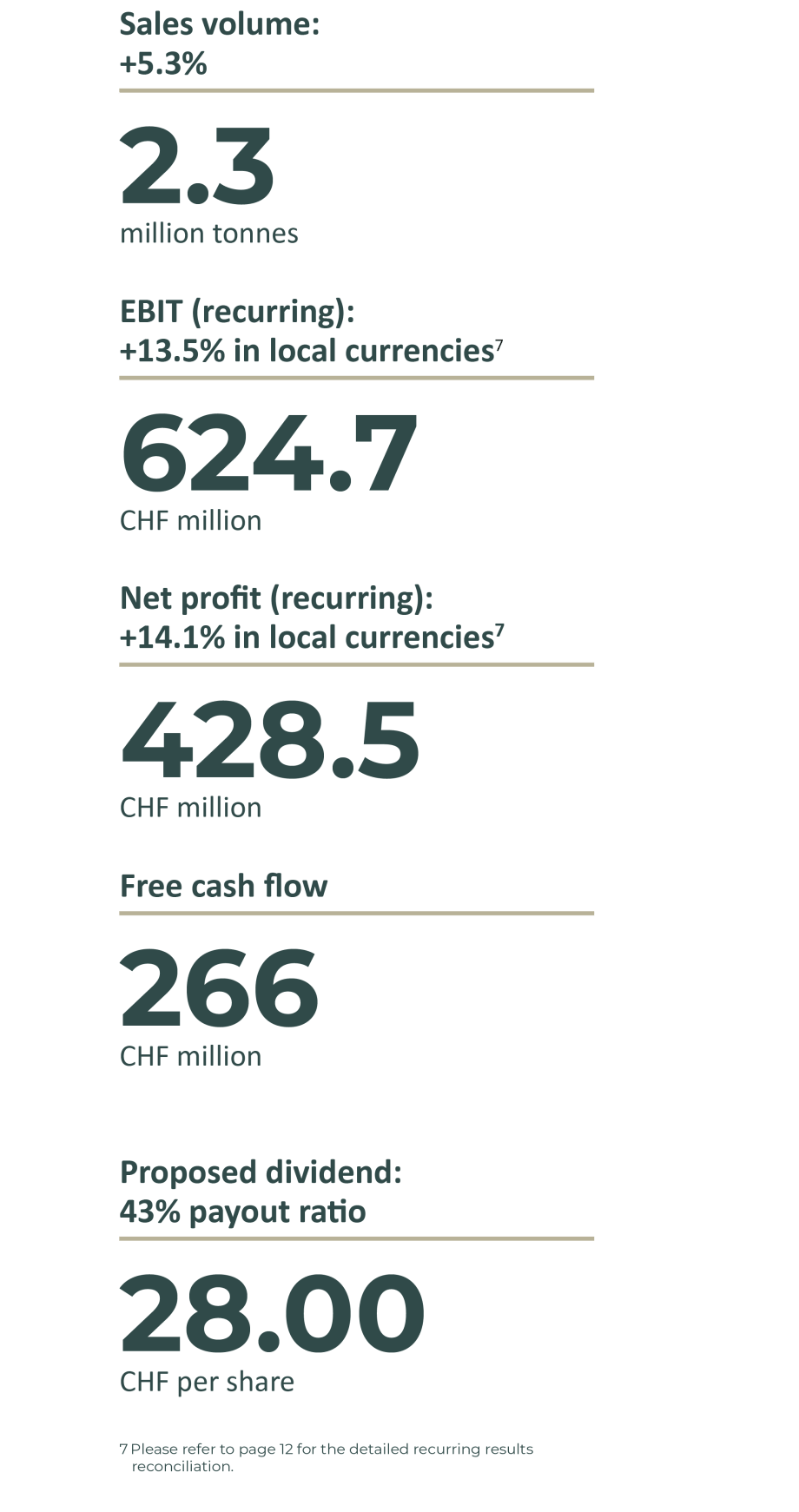

- Sales volume up +5.3%, with solid chocolate performance (+5.9%)

- Sales revenue of CHF 8.1 billion, up +14.6% in local currencies (+12.3% in CHF)

- Operating profit (EBIT) recurring1 of CHF 624.7 million, up +13.5% in local currencies (+10.2% in CHF). EBIT reported of CHF 553.5 million, up +0.1% in local currencies (-2.3% in CHF)

- Net profit recurring1 of CHF 428.5 million, up +14.1% in local currencies (+11.4% in CHF). Net profit reported of CHF 360.9 million, down -4.7% in local currencies (-6.1% in CHF)

- Continued good cash generation with adjusted Free cash flow2 of CHF 358.5 million

- On track to achieve mid-term guidance3

- Thomas Intrator proposed as new member of the Board of Directors

- Proposed stable dividend of CHF 28.00 per share, a payout ratio of 43%

1 Please refer to Annual Report page 175 for the detailed recurring results reconciliation.

2 Adjusted Free cash flow is adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories.

3 On average for the 3-year period 2020/21 to 2022/23: 5 - 7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

Risk overview

The Group operates in the food industry and is exposed to a variety of risks and uncertainties. The Group’s Enterprise Risk Management framework is designed to identify, assess and mitigate key risks by taking appropriate measures to ensure the achievement of the Group’s objectives.

Overall responsibility for establishing, reviewing and adapting the company-wide governance, risk management, compliance and control processes lies with the Board of Directors (the Board). The Board has delegated responsibility for evaluating the Group’s risk and control environment to the Audit, Finance, Risk, Quality & Compliance Committee (the AFRQCC).

Implementation and execution of the risk management processes are delegated to the Executive Committee (the ExCo) and further cascaded to regional and functional management.

Our strategy

Sustainability

Sustainability is at the heart of Barry Callebaut, representing one of our four strategic pillars. In 2016, we launched Forever Chocolate, the next chapter in our long-standing commitment to building a sustainable cocoa and chocolate supply chain.

Halfway through our Forever Chocolate timeline, we have used the past year to take stock of the impact we have generated since 2016 and how well we are on track to achieve our targets. In addition, as the future requirements for a sustainable chocolate supply chain are constantly evolving and transforming, we have assessed where our targets need sharpening. Our conclusion? We need to add fresh ambition to our Forever Chocolate Plan. In fiscal year 2022/23 we will present a set of sharpened targets, using our ongoing Forever Chocolate targets for 2025 as a springboard.

Our sixth Forever Chocolate progress report, covering fiscal year 2021/22, shows that we continue to scale up our activities by partnering with customers as well as societal and industry stakeholders to create tangible impact on the ground, while at the same time publicly advocating for policies to make sustainable chocolate the norm.

Our over 1,600 colleagues in cocoa-origin countries give us a unique pool of expertise. As an early sustainability adopter in the cocoa and chocolate industry, we have developed strong sustainability know-how and capabilities.

That is a key enabler of our robust program implementation and impact-driven solutions and a point of differentiation for our customers. We continue to be the preferred partner to drive impact, delivering on our Forever Chocolate ambitions, and addressing customer needs.