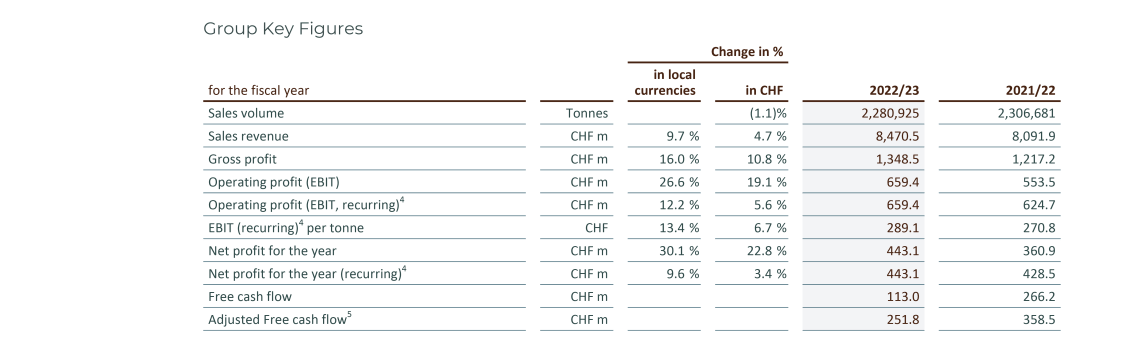

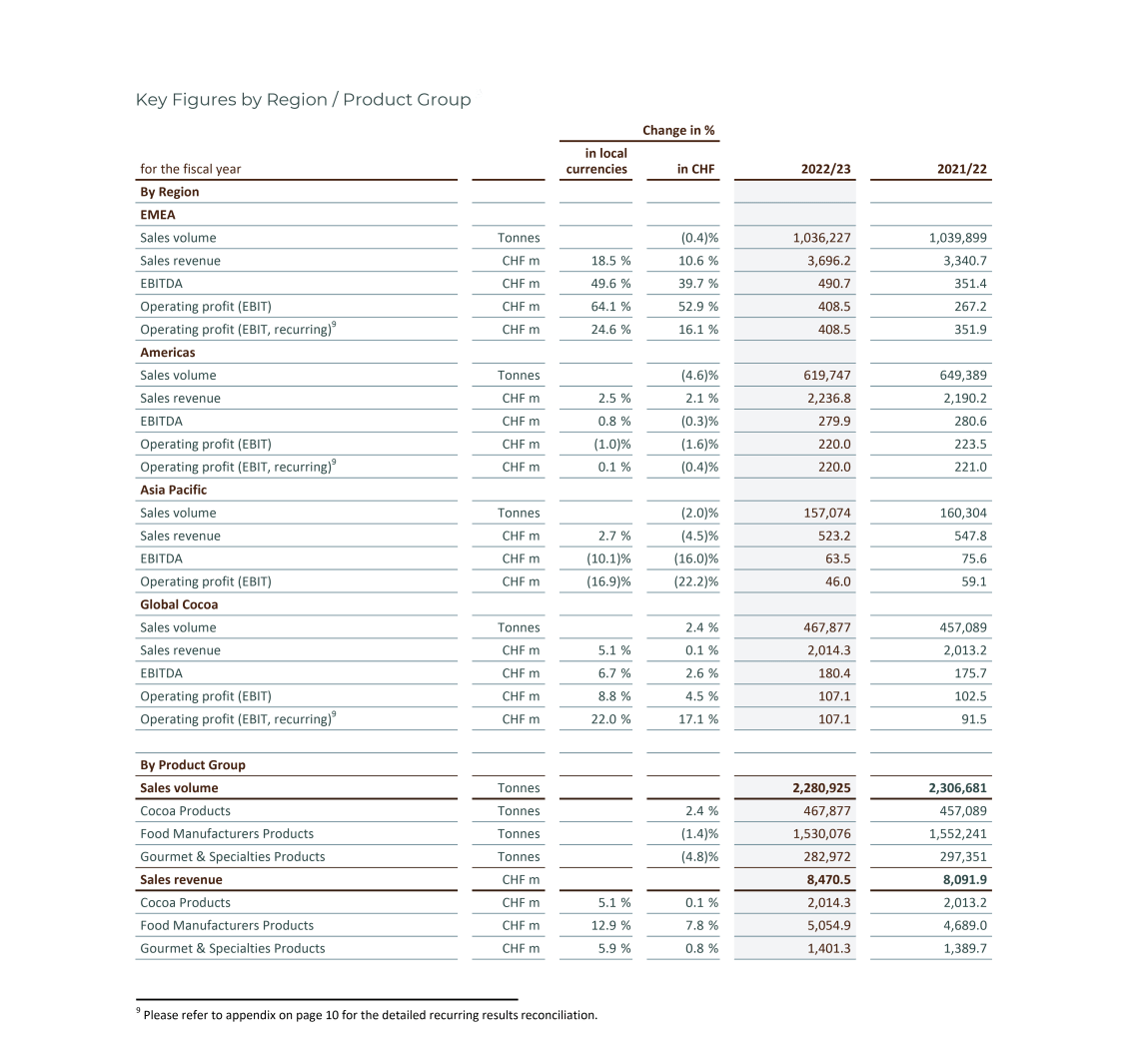

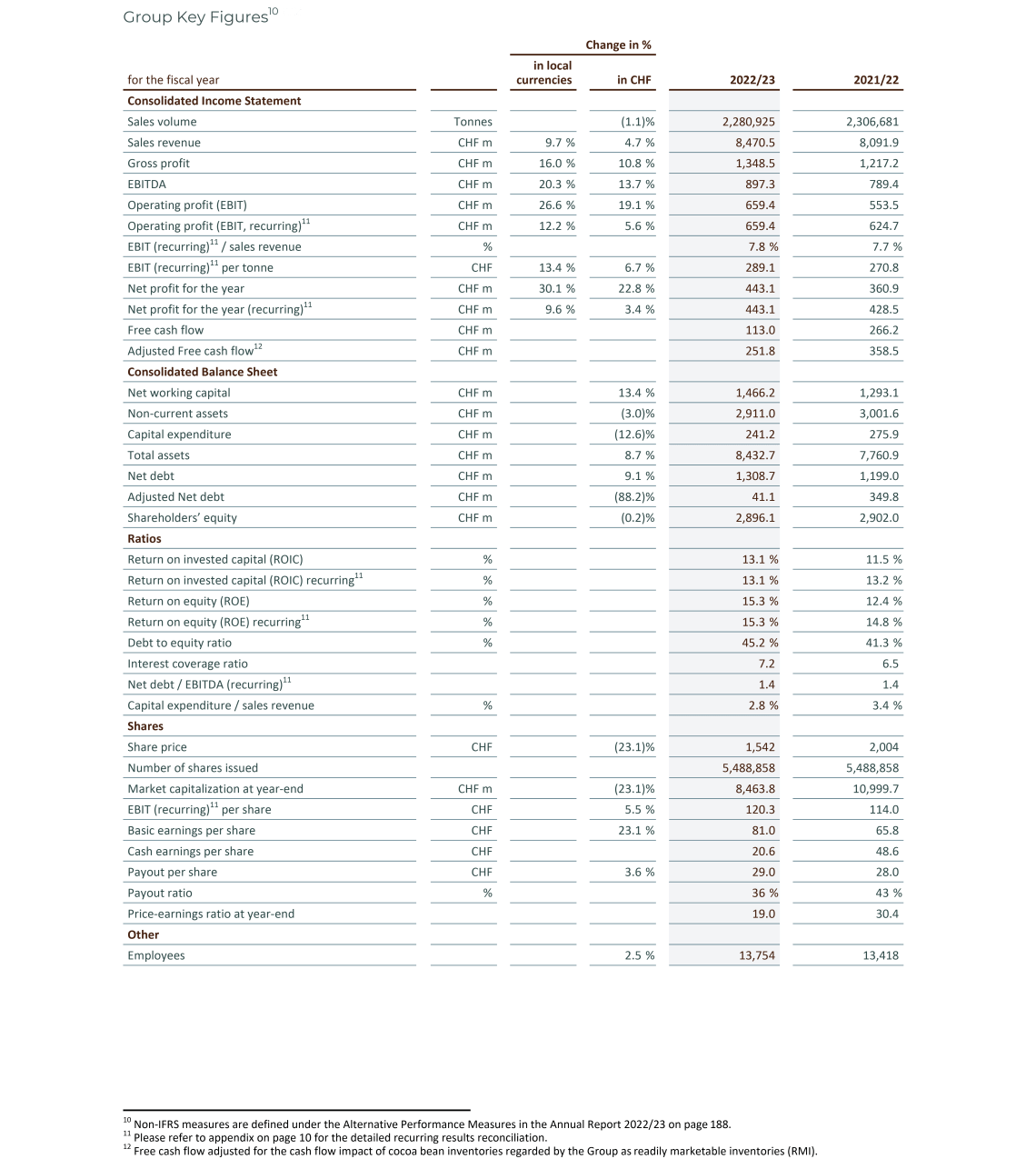

The Barry Callebaut Group saw a slight sales volume decline of -1.1% to 2,280,925 tonnes in fiscal year 2022/23 (ended August 31, 2023). Volumes were negatively affected by the prior year's salmonella incident in Wieze which continued to impact results in Q1 2022/23, as well as by the weaker customer demand and increasing raw material prices.

The chocolate business reported a decline of -2.0%, with the global chocolate confectionery market declining -1.0%6.

While EMEA volume declined in the first half of the year, recovery of +3.2% growth in the second half resulted in flat performance of -0.4% in the year. Asia Pacific and Americas both continued to see softer customer demand amid challenging markets, declining -2.0% and -4.6% in the year respectively.

In terms of the key growth drivers: Outsourcing (strategic partnership) volumes grew +1.7% (+4.8% in Q4). Gourmet & Specialties declined -4.8% due to lower demand and temporary stock unavailability earlier in the year due to the Wieze incident, but gradually recovered and ended the final quarter positive at +0.2%. Emerging Markets were broadly flat at -0.2%. Sales volume in Global Cocoa increased to 467,877 tonnes, a year-on-year increase of +2.4%.

Sales revenue amounted to CHF 8,470.5 million, up +9.7% in local currencies (+4.7% in CHF). The increase was driven by high raw material price increases and the overall inflationary environment.

Gross profit exceeded volume performance and amounted to CHF 1,348.5 million, up +16.0% in local currencies (+10.8% in CHF), as the inflationary environment was well managed through the company's cost-plus pricing model.

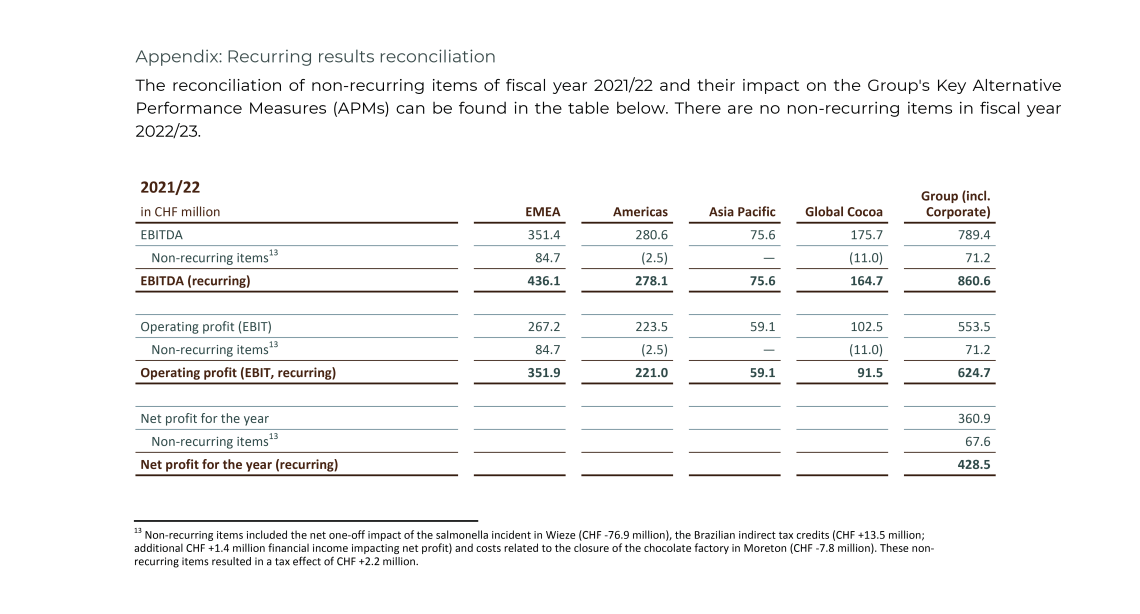

Operating profit (EBIT) amounted to CHF 659.4 million, up +12.2% in local currencies (+5.6% in CHF) compared to prior-year EBIT recurring4, well ahead of volume. Performance improved in comparison to the softer prior year, which was heavily impacted by the Wieze incident in the final fiscal quarter, leading to lower volumes and related Operating profit (EBIT) recurring4. In addition, the strong result in the Global Cocoa business contributed to the year-on-year increase. EBIT per tonne improved to CHF 289, up 13.4% in local currencies (+6.7% in CHF), compared to EBIT recurring7 per tonne in the prior year of CHF 271. EBIT reported amounted to CHF 659.4 million vs. CHF 553.5 million in the prior year.

Net profit amounted to CHF 443.1 million, up +9.6% in local currencies (+3.4% in CHF) compared to prior-year net profit recurring7. The net finance costs slightly increased to CHF -124.1 million, up from CHF -121.8 million in prior year, as a result of higher interest benchmark rates. The income tax expense amounted to CHF -92.1 million in 2022/23, corresponding to an effective tax rate of 17.2% (16.4% in prior year).

Net working capital increased to CHF 1,466.2 million, compared to CHF 1,293.1 million in prior year. The increase was driven by the net effect of higher raw material prices on receivables, inventories and derivatives.

The adjusted Free cash flow8 decreased to CHF 251.8 million, compared to CHF 358.5 million in the prior year. Before the adjustment for cocoa bean inventories regarded by the Group as readily marketable inventories (RMI), cash flow generation declined to CHF 113.0 million, compared to a strong prior year (CHF 266.2 million). Free cash flow was heavily impacted by increases in raw material prices, particularly cocoa, which strongly affected net working capital.

Net debt increased to CHF 1,308.7 million from CHF 1,199.0 million in the prior-year period as working capital requirements expanded following raw material price increases. Taking into consideration the cocoa bean inventories regarded as readily marketable inventories (RMI), adjusted net debt decreased to CHF 41.1 million compared to CHF 349.8 million in the prior-year period.

4 Refer to appendix (on page 10 of the PDF) for the detailed recurring results reconciliation.

5 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

6 Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2022 to August 2023, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

7 Please refer to appendix (on page 10 of the PDF) for the detailed recurring results reconciliation.

8 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).