Business Review EMEA

2019/20

Business Review EMEA

2019/20

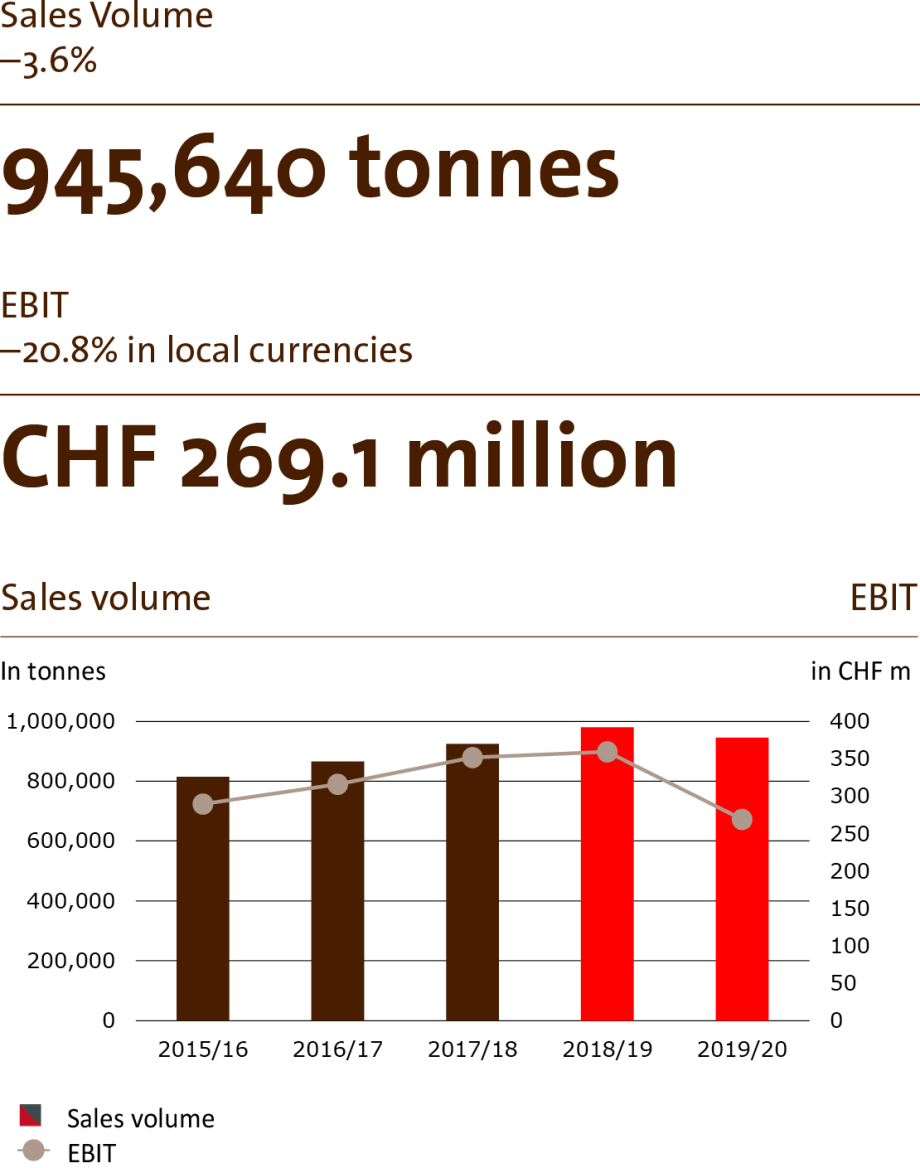

Sales volume in Region EMEA (Europe, Middle East and Africa) declined by –3.6%1 to 945,640 tonnes. Excluding the first-time consolidation of Inforum as of February 2019, organic volume declined by –5.2%. As distribution channels were gradually reopening, Gourmet & Specialties began to recover in the fourth quarter, limiting the decline for the fiscal year under review to the high teens, after its volume was nearly halved in the third quarter. Food Manufacturers rapidly recovered in the fourth quarter, leading to a small decline in the low single-digit range for fiscal year 2019/20.

Sales revenue amounted to CHF 2,915.8 million, a decline of –0.9% in local currencies (–5.5% in CHF).

Operating profit (EBIT) amounted to CHF 269.1 million, down –20.8% in local currencies (–25.2% in CHF) due to the adverse mix.

In May 2020 Barry Callebaut signed an agreement for the long-term supply of compound and chocolate with a large chocolate confectionery manufacturer in Eastern Europe. The ramp-up starts in the first quarter of fiscal year 2020/21.

Barry Callebaut deepened its presence in the UK with its revamped CHOCOLATE ACADEMY™ Center in Banbury, inaugurated in January 2020. The new Global Distribution Center in Lokeren, Belgium, and the Group’s first chocolate factory in Southeastern Europe, in Novi Sad, Serbia, are taking shape and are expected to be operational by 2021.

1 The underlying chocolate confectionery market growth according to Nielsen does not include e-commerce and only partially reflects the out-of-home and impulse consumption. Volume growth for the period September 2019 to August 2020 in EMEA was +1.5%.